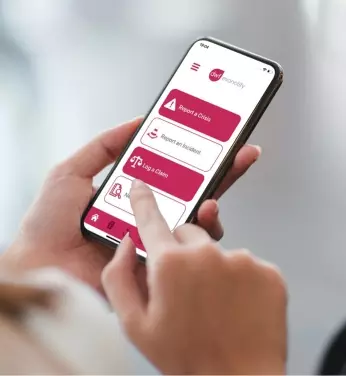

End-to-end claims management services & expertise

Our complete claims management offering combines technical excellence and superior service across the whole lifecycle of handling a claim. Our centralised approach generates greater efficiencies and lower costs for our clients, as well as ensuring a seamless service across multiple, widespread territories.