Insurers need a claims process that is:

- Data Driven – to produce comprehensive MI for management of risk and reinsurance reporting at the granular level needed by cyber insurers

- Streamlined – from hotline to resolution, our process integrates all aspects of cyber claims

- Transparent - to avoid extra contractual exposures with state of the art policy integrity measures

- Adaptable – to a rapidly evolving cyber environment with the ability to provide bespoke MI and identification of shifts in the cyber underwriting market

How we can help you

Innovation is the cornerstone of how we deal with cyber security claims. Key to this is how we combine technology, intelligence and data analytics to act as a trusted cyber advisor and help deliver our clients objectives.

Our dedicated cyber claims team in the UK, Ireland, Canada, France, Italy, Central and Eastern Europe, Australia and the USA work closely with insurers to identify as early as possible, the extent of cover available and manage the successful resolution of the claim.

We offer a fully integrated approach to managing your cyber claims or the option to select specific services to integrate into your existing claims process, for example supporting your monitoring counsel in the production of key data and MI.

Our integrated legal and business services include forensic accountants, specialist adjusters, data analysts, insurance lawyers and expert litigators.

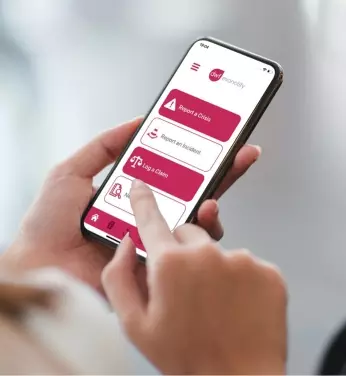

EvoClaim gives DWF the ability to track and report data reflecting this complexity and provides clients with real-time access to full electronic files and comprehensive claims data.

A client dashboard provides instant graphical analysis on loss codes, insured categories, geographic locations, number of new/closed claims and claims trends.

EvoClaim reduces claim life cycles and the management time associated with a cyber or data breach; by producing bespoke management information it enables you to adopt a robust and proactive approach to addressing cyber risks and claims.