The Chancellor, Jeremy Hunt, delivered his Autumn Statement on 22 November 2023. Whilst previously saying there would be little room for tax cuts this year, the Government considers that it is in a better position to be able to deliver some tax cuts and incentives for businesses and individuals, largely due to falling inflation rates and an increased tax take from maintaining income tax thresholds for a number of years.

With a general election in sight, the Chancellor began his speech stating he had 110 measures to boost growth for businesses. Whilst the Tax team at DWF is busy analysing the detail, some of the key points include:

Full expensing made permanent

At Spring Budget, the Government introduced temporary "full expensing" for certain capital expenditure by companies subject to corporation tax on new qualifying plant and machinery between 1 April 2023 and 31 March 2026. In the Autumn Statement, the Chancellor announced that "full expensing" would be made permanent. This measure had been expected and will be welcomed by many businesses.

Full expensing enables companies to claim:

- 100% corporation tax relief on new qualifying "main pool" expenditure (which accounts for most plant and machinery); and

- 50% initial relief for "special rate pool" expenditure (which includes certain types of long life assets (with expected economic lives of over 25 years) and integral features), with the balance of the special rate pool expenditure written off in future accounting periods currently at a rate of 6%.

The full expensing regime was designed to fill the gap left behind by the end of the "super-deduction" (which applied to capital expenditure from 1 April 2021 to 31 March 2023). The announcement to make "full expensing" permanent will provide greater clarity for businesses planning long term capital expenditure.

Making the full expensing rules permanent means an enduring and significant difference in the way that certain capital expenditure is treated, as some capital expenditure does not qualify for full expensing. This includes used and second hand plant and machinery, as well as cars and certain leased capital items, although the Government has committed to publishing a technical consultation to consider any potential extension to include plant and machinery for leasing.

As leased plant and machinery remains outside of the scope of full expensing for the time being, the distinction between "background plant and machinery" in buildings (in respect of which full expensing may be available even though the building is leased) and other plant and machinery (in respect of which full expensing will not be available where the plant and machinery is leased), will continue to be important.

The Government intends to legislate for this change in the next Finance Bill and has committed to launching a technical consultation on wider changes to the capital allowances legislation, with a view to making the operation of the regime simpler.

Research and development tax relief

Following a consultation launched by the Government at Spring Budget 2021 to review the UK's Research and Development ("R&D") tax regimes, the Chancellor announced three changes in the Autumn Statement:

- the merger of the Small and Medium Enterprise ("SME") and Research and Development Expenditure Credit ("RDEC") schemes;

- enhanced support for R&D intensive SMEs; and

- a restriction of nominations and assignments for R&D reliefs.

There are currently two schemes to enable companies to claim R&D tax relief, which operate differently: the R&D SME scheme and the RDEC scheme.

From 1 April 2024, the schemes will be merged, resulting in a single R&D tax credit, initially implemented at the rate of 20% (mirroring the RDEC regime) whilst incorporating the PAYE and National Insurance contributions cap which is a feature of the SME scheme.

The Government suggests that the merger will simplify and improve the claim process, whilst reducing high levels of non-compliance in claiming R&D reliefs.

SMEs that are defined as 'R&D intensive' and loss-making, qualify for a higher rate of R&D credit. The Autumn Statement extends the definition of an R&D intensive company from one whose R&D expenditure constitutes at least 40% of its total expenditure to one whose R&D expenditure is at least 30% of total expenditure from 1 April 2024. The Government estimates that the reduction in the expenditure threshold will result in a further 5,000 R&D intensive SMEs being eligible for the enhanced relief.

With effect from 22 November 2023, tax credits will no longer be assignable to a third party. Further, from 1 April 2024, all R&D claimants (whether under the current schemes or the merged scheme) will receive their R&D tax credit payments directly, and HMRC will make payments to third parties in only limited and exceptional circumstances.

HMRC acknowledges that the use of nominations is generally not associated with fraud, but that a high proportion of fraudulent R&D tax credits claims do use nominee accounts. The Government therefore believes that this measure will help reduce non-compliance from its current estimated level of 16.7% of the total value of tax credit claims.

R&D tax credits are valuable to businesses in almost all sectors and of all sizes. The changes announced at Autumn Statement are designed to make the system easier to navigate, and will hopefully allow HMRC the time and resource to engage properly where they are undertaking enquiries into claims.

National insurance contributions

The headline announcement is a cut of two percent to employee Class 1 National Insurance contributions from 6 January 2024. Currently, employees pay 12% Class 1 National Insurance on earnings over £12,570, and 2% on earnings over £50,270.

For the self-employed, the Chancellor also announced measures to cut both Class 2 and Class 4 National Insurance contributions. Currently, Class 2 contributions are set at the flat rate of £3.45 a week, which individuals pay if their profits exceed £12,570 a year. Class 4 contributions are charged at 9% on profits between £12,570 and £50,270, and at 2% on profits over £50,270. The Autumn Statement announced the abolition of the compulsory flat-rate charge for Class 2 contributions from 6 April 2024, although individuals may still make voluntary contributions. In addition, the tax rate on earnings between £12,570 and £50,270 for Class 4 contributions will decrease by one percent, bringing it down to 8%.

The reductions in National Insurance contributions rates will directly affect a person’s take-home pay. The Chancellor stated that an employee earning £35,000 (the average UK salary) would take home approximately £450 more per year. Furthermore, he asserted that around two million self-employed individuals would see an average increase of £350 in their annual income, starting from April 2024.

Whilst National Insurance contributions rates have been cut, the income tax and National Insurance contributions thresholds for individuals remain frozen at current levels until 2028. As a result of inflation and wage growth, along with the increase in the National Living Wage, more people will be pulled into either paying tax or the next tax band. According to the Office for Budget Responsibility forecast, these frozen thresholds will result in "nearly four million additional workers paying income tax, three million more moved to the higher rate, and 400,000 more paying the additional rate".

Businesses should be ready for required payroll changes for January 2024 and internal communications with employees.

National Living Wage

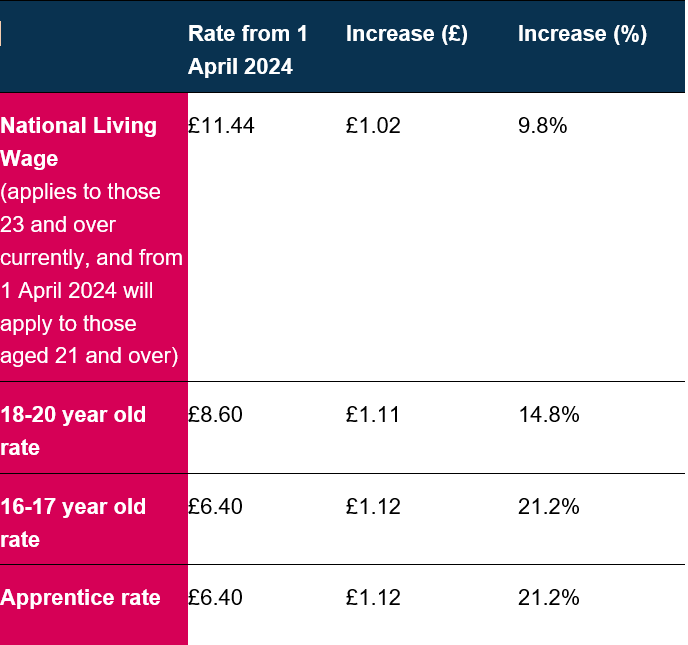

National Living Wage ("NLW") is the statutory minimum wage for workers aged 23 and over. The Government announced on 21 November 2023, that with effect from 1 April 2024, NLW would apply to those aged 21 or over. Rates for minimum wages will increase as follows: