The Claims Portal data has now been released for December 2020, which rounds off this COVID affected claims year. In this update we shall take a look at what the effect has been on the year as a whole and what we can expect in 2021. We also take a more detailed look at the effect on medical examinations based on the quarterly MedCo data.

Whilst we are seeing an increasing number of people receiving their vaccinations, over six million at the time of going to press, sadly deaths are at an all-time high and it does seem that Covid will continue to impact upon our everyday lives for the foreseeable future. The current lockdown rules in England are to be reviewed by the government on 15 February but it is widely expected that there will be no release until March, and then only gradual.

Initial indications are that the reduction in transport usage during the current lockdown is not as dramatic as it was during the first lockdown, but much more so than the second mini-lockdown during November 2020, particularly given the school closures. Additionally from a claims perspective, January has already seen long periods of snow, heavy rain and widespread flooding so despite the reduction in traffic from lockdown, it has not necessarily been a quiet start to the year for claims teams.

Whiplash Reforms

The whiplash reforms are likely to dominate the claims landscape in 2021. Since our last update there has been the inevitable announcement of the delay to the reforms, although as predicted the delay is measured in weeks rather than months. The MOJ simply announced the reforms would be implemented in 'May', but it would be optimistic to think it would be anything other than the close of the month. You can read more about the announcement in our update here.

There is still plenty left to do but we understand the Pre Action Protocol is now signed off by the CPRC and the next step will be reviewing the Practice Direction and Rule Changes when the CPRC meets again on 5 February. It remains to be seen whether the MOJ will release the PAP next week or wait until the PD is signed off and release all together, although we suspect the latter. The MOJ has promised a three month gap between publication of the rules and implementation, and they also know they will only have a limited window in the parliamentary timetable to have the regulations approved. So one way or another, unless there is a fly in the ointment we should see the Rules published during February, leaving three months for preparation.

As an aside, late last week the FCA published proposals to cap the fees claims management companies can charge their customers. For now this applies to financial products and services but maybe in a sign of things to come they did indicate that they would subsequently consider whether there is a need for fee rules in other areas, including personal injury.

Costs Consultation

The Civil Justice Council working party chaired by Mr Justice Stewart have produced their report reviewing the Guideline Hourly Rates, recommending what they describe as modest increases on the previous rates, which were last reviewed in 2010, with a further review of GHRs proposed in three years' time.

Eleven years of inflationary increases make the rises look fairly significant as the hourly rates have been static for so long. For example, Liverpool which is National 1 category would rise from £217 per hour to £261 under the proposed changes, a rise of 20.2%. London category one rates rise by 25.2% to £512, an eye watering figure but taking into account the amount of commercial litigation carried out in the capital. Of course, the opportunities for many lawyers to recover costs is much diminished these days after fixed costs and QOCS. It has also been recommended that rather than split the country into three other categories, National 2 and National 3 rates will be amalgamated.

A consultation has been launched on the findings of the report, which closes on 31 March 2021. You can read our full update on the review here.

E-Scooters and Vehicle technology

Trials for e-scooters are ongoing, expected to last one year from being put into place. Logistical problems have meant that the London trials, perhaps the most important, are yet to start. However, the earlier trials in cities such as Birmingham, Bristol and Liverpool should yield some data outputs initially. If the UK government intends to depart from Vnuk as it is expected to do, ultimately this will have an impact involving accidents on private land and whether the insurance industry will have to carry the risk. Bespoke insurance products are likely to be created to cover e-scooters on roads in due course. As we have said previously, the concern is that data from regulated trials with compulsory insurance, licensed riders with limited speeds and in a controlled environment may not yield true representative results of how it will really operate if and when e-scooters are legalised.

Meanwhile in Kent a woman has become the first person to be convicted of drink-driving (riding?) on an e-scooter. She had been downing shots before nearly colliding with a police car and unsurprisingly, the officers inside decided to arrest her. She was banned for two years and given 40 hours community service.

On a similar theme, smart motorways have come into criticism over the last few days for causing a significant number of high-risk accidents. Smart motorways utilise the hard shoulder as an extra lane to reduce congestion. The coroner in a case where two men were killed ruled that the lack of hard shoulder contributed to those deaths. Highways England are disputing that smart motorways increase risk of death and serious injury on motorways, stating that casualty rates had reduced by between 18% and 23% since their introduction. Greater assessment of the position is needed and a full review is likely in due course.

Additionally the Department for Transport have released a study, analysing the potential future Connected and Autonomous Vehicles (CAVs) market for the UK. The study updates the September 2017 market forecast and you can read it here.

Use of Transport Modes up to mid-January 2021

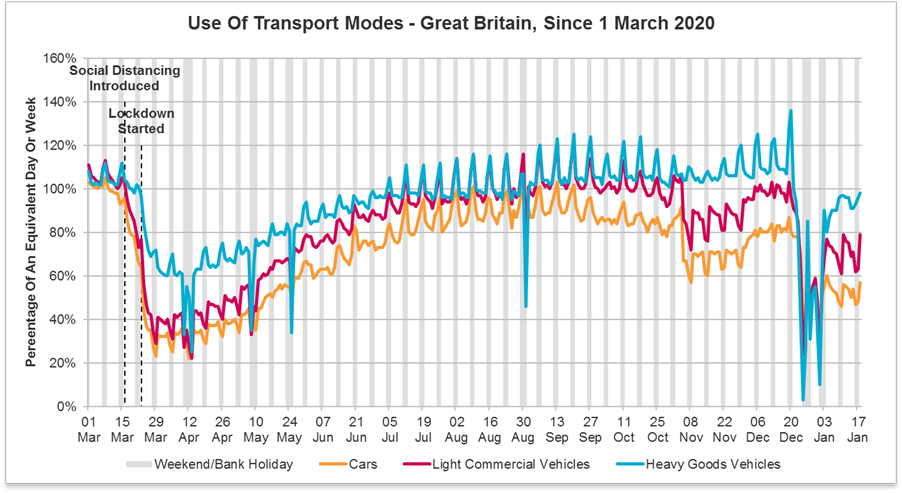

We start our data analysis with the latest transport data:

The latest figures go up to 18 January 2021 and show private car usage reduced to around 55% of pre-lockdown levels (from around 80% in mid-December). That can be contrasted with the first lockdown where use of private cars dropped as low as 22%

Light commercial vehicles and HGVs have also seen marked reductions but again nothing approaching the April/May lows. Part of the answer may lie in the public transport statistics with national rail and the London tube network around 15% of normal use in the early part of 2021.

From a claims perspective there has no doubt been a further reduction in the level of claims which had reached around 80% of pre-lockdown levels, but this will be offset slightly by the inclement weather. Predicting change is difficult until we know when schools and retail shops will re-open, but one would suspect any significant recovery unlikely to take place until around May – just in time for the whiplash reforms maybe…

In any event, history tells us that when costs reforms (which the whiplash reforms are) are introduced there is a reduction in claims whilst the market takes stock. We anticipate a similar projection for the whiplash reforms whilst the market works out where the money is to be made.

Working Practices and Footfall

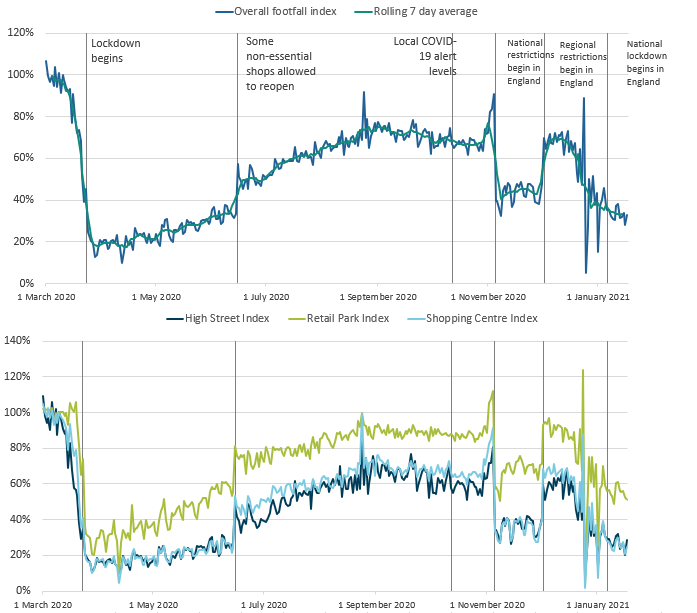

The ONS statistics since the countrywide lockdown came in at the end of December have unsurprisingly had an effect on footfall and working practices. Those working exclusively at home increased by 8% on the prior period, to 34%. With non-essential retail shut, the proportion of adults who shopped for items other than food and medicine was reduced by 10% to only 6%. Coronavirus and the latest indicators for the UK economy and society - Office for National Statistics.

In the week ending 17 January 2021, overall footfall is at 33% when compared with the same week a year ago, with the high street being hardest hit.

Civil Justice Statistics

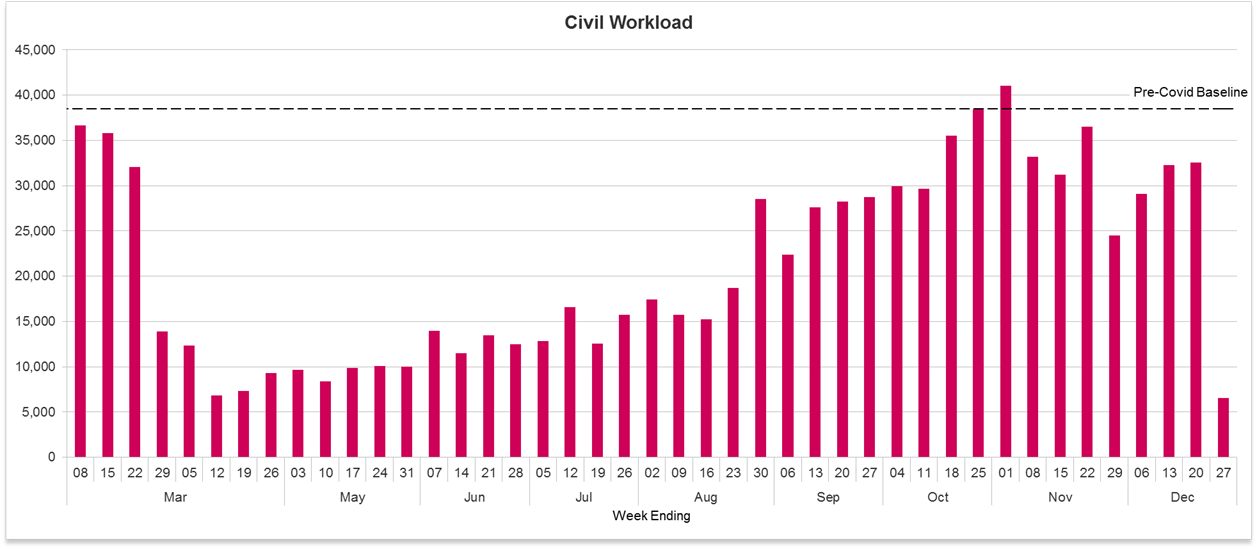

November had seen a reduction in issued cases during the lockdown. December saw the number rise again, then inevitably drop off over Christmas as courts and businesses closed for the festive period:

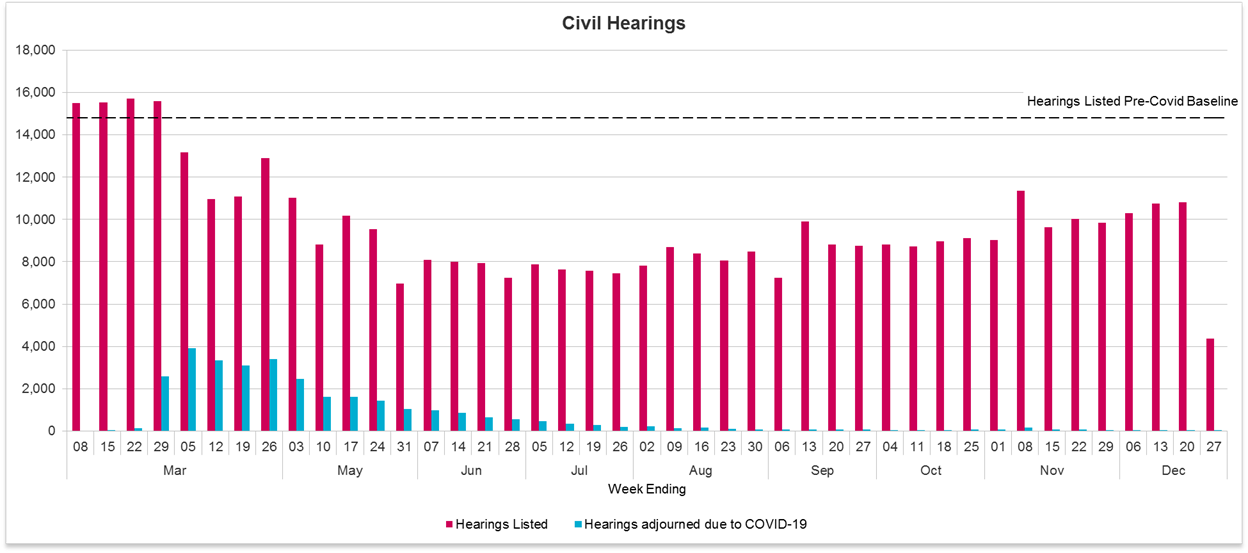

It was a similar story with civil hearings, with a general recovery in the main part of December and then the seasonal drop off. However with restrictions on hearings in person remaining and not all trials suitable for remote hearings, the numbers remain well below pre-lockdown levels nine months on:

MedCo Data

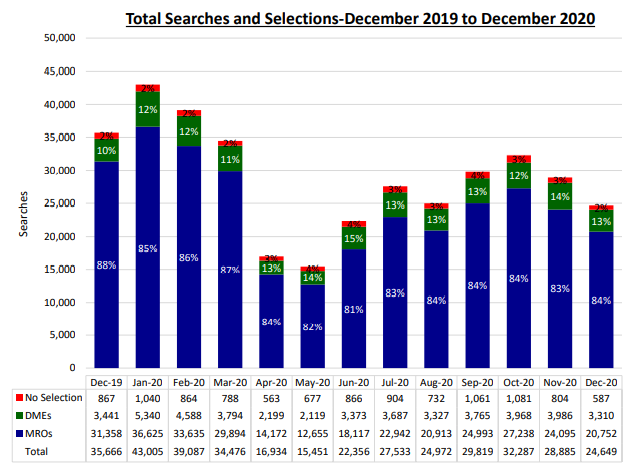

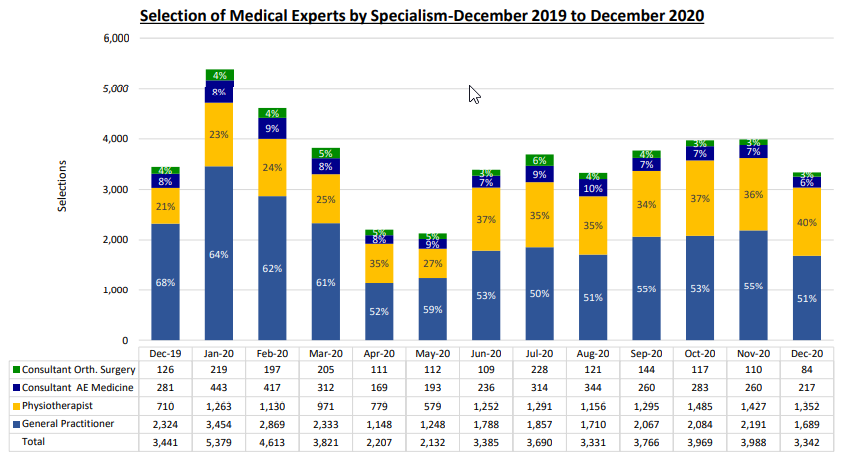

Something that may often go under the radar is the quarterly data released by MedCo showing statistics on the use of medical experts for soft tissue injuries in RTA through the MedCo system.

The latest report demonstrated the impact of lockdown with a significant reduction during the course of the year in the number of overall searches for a MedCo medical report – 35,666 in December 2019 down to 24,649 in December 2020.

Of further interest was the increased selection of physiotherapists when selecting direct experts, which went from 21% of selections in December 2019 to 40% in December 2020 having steadily increased ever since March.

Portal Data

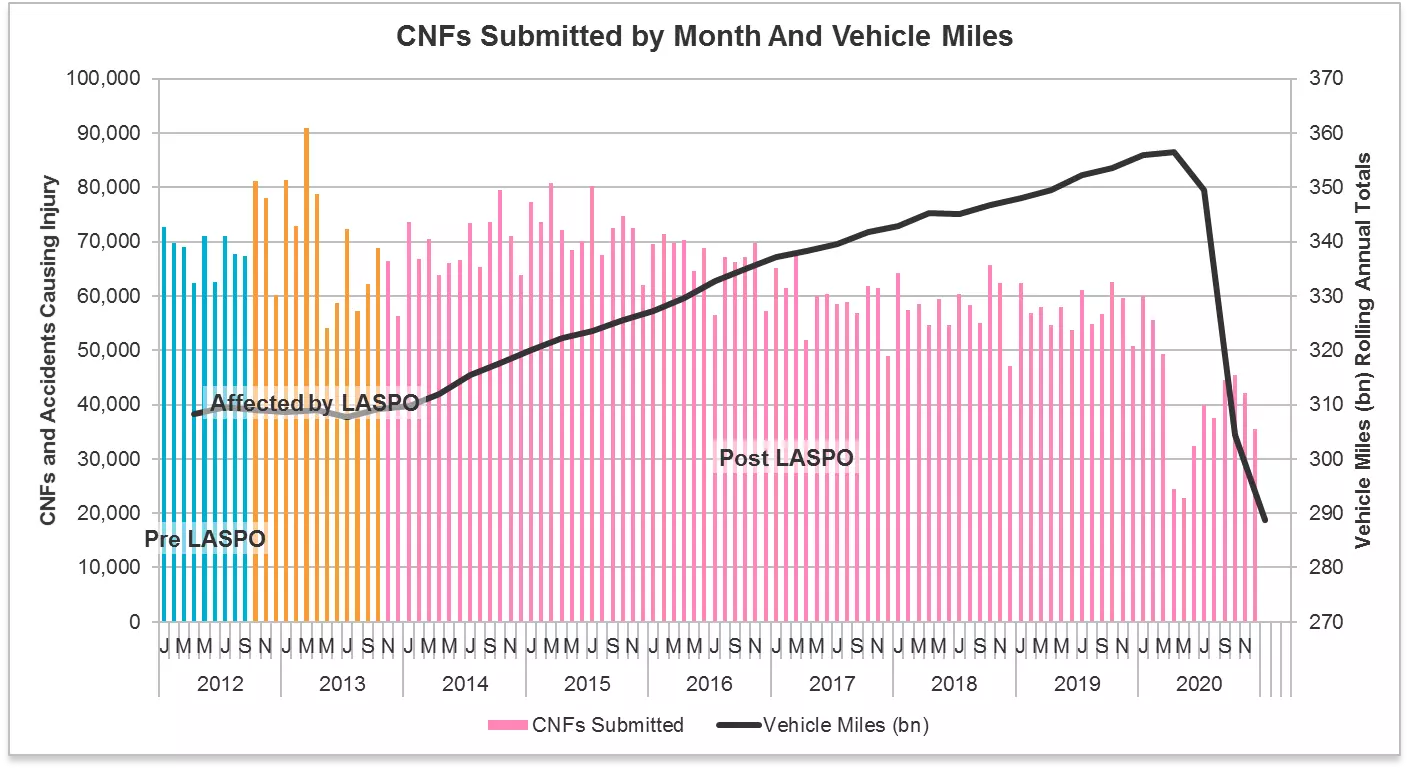

December saw a further decline in numbers of cases across the board, despite the fact that the tiered approach was in place, with some parts of the country not in lockdown and both retail and schools open in many areas. However, there is a lag between accidents and claims, so we will be seeing the impact of the November lockdown, and the inevitable seasonal effect.

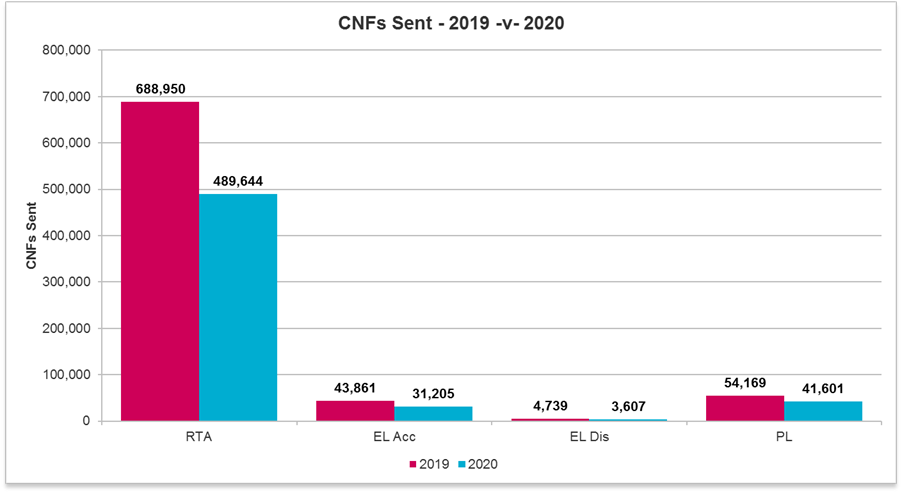

With the full year statistics now available we can make a whole year comparison between 2019 and 2020, to see the full impact of Covid over the course of 2020 in all types of claims:

New RTA claims

New RTA claims fell to the lowest level since June 2020, with 35,480 new claims being submitted. This is a 15% drop on the prior month and a 30% drop on the same month in the previous year.

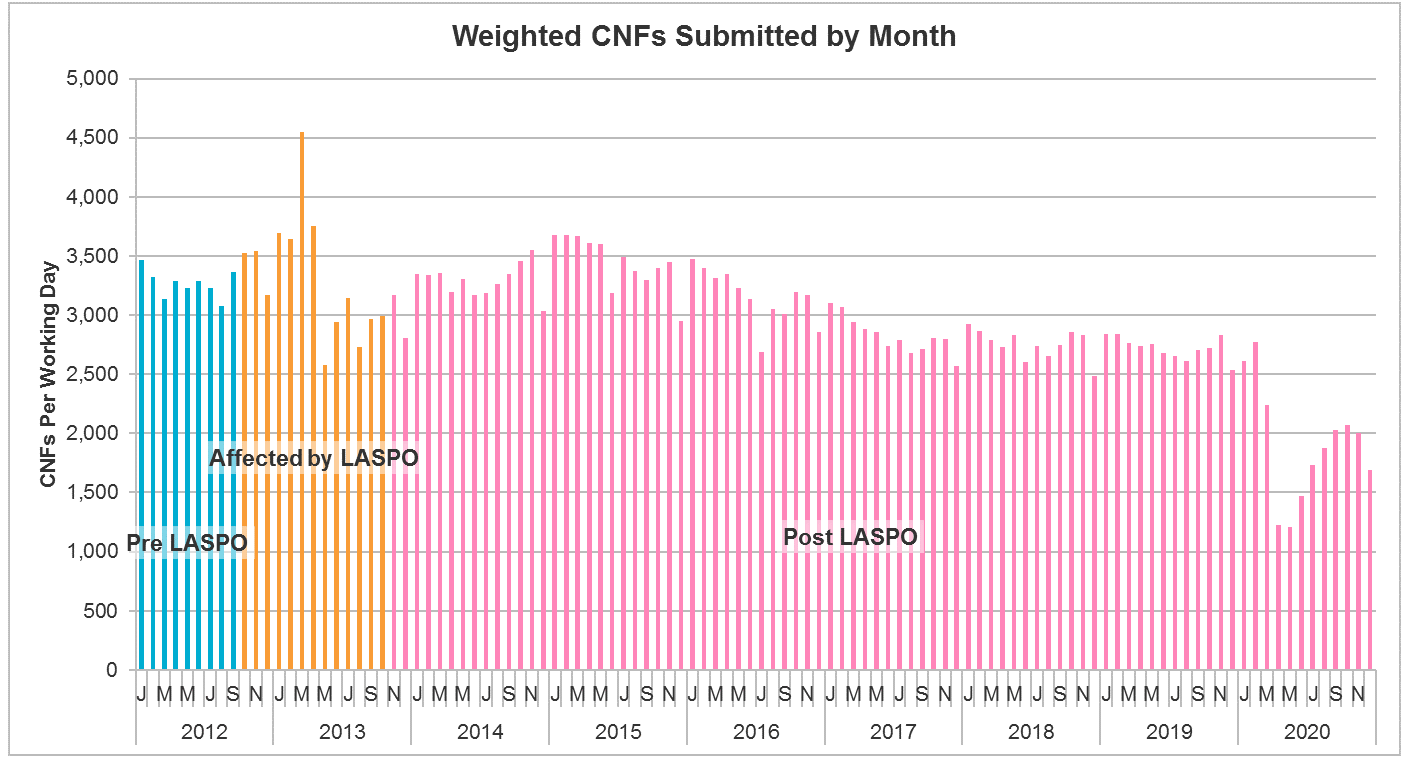

Even taking into account the reduced number of working days in December, the reduction against November is clear, although as we have said there is a customary drop in December as the eagle eyed will be able to see from the graph below:

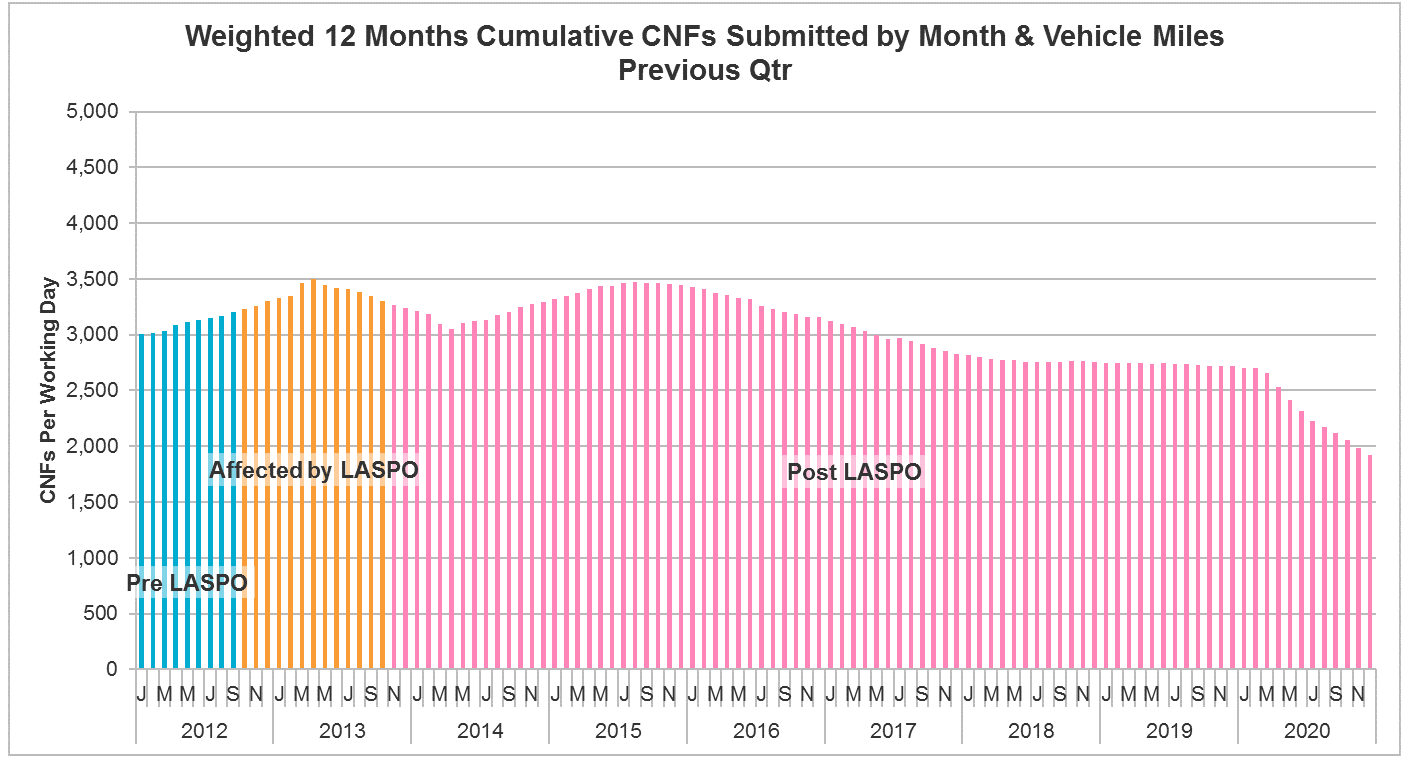

We've mentioned the 12 month position above but also have an additional metric showing the cumulative weighted numbers of CNFs per day per month:

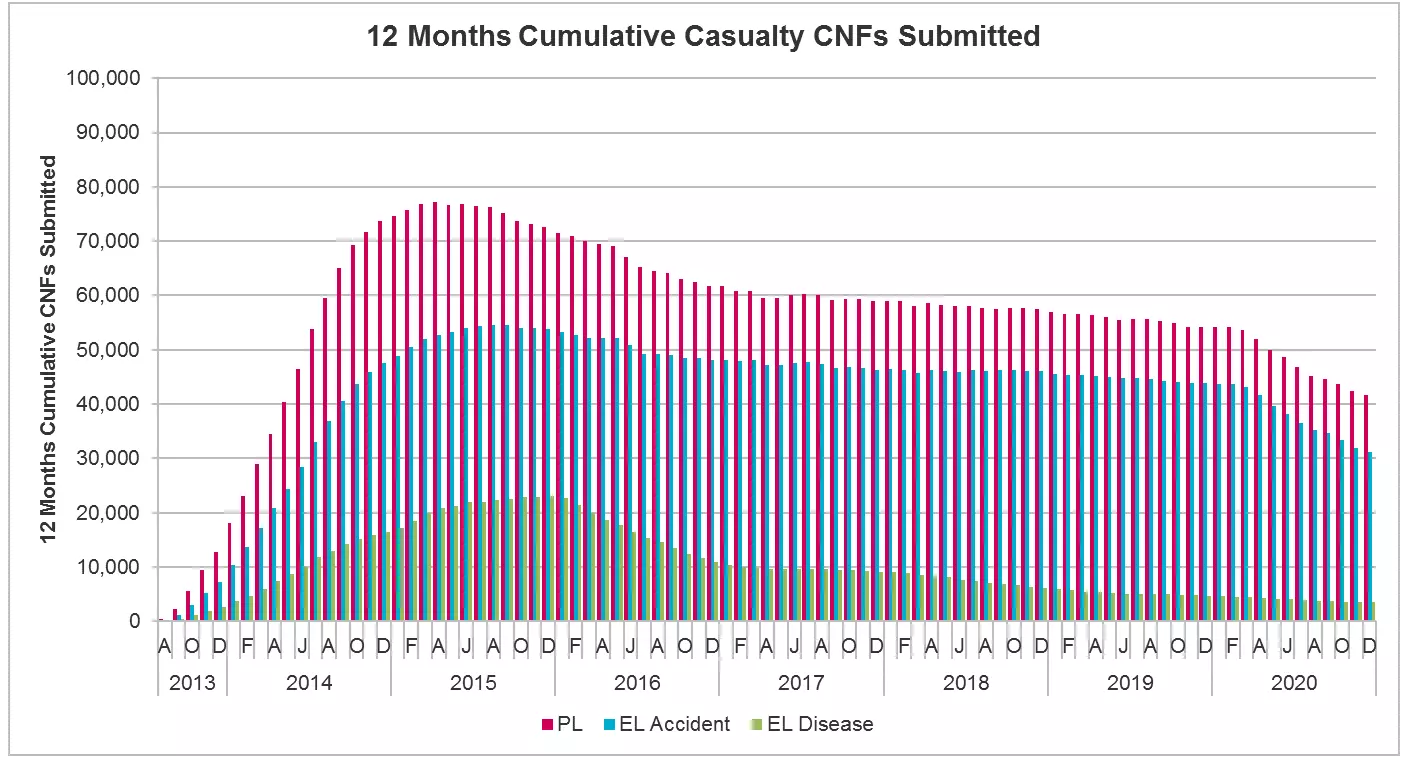

New Casualty Claims

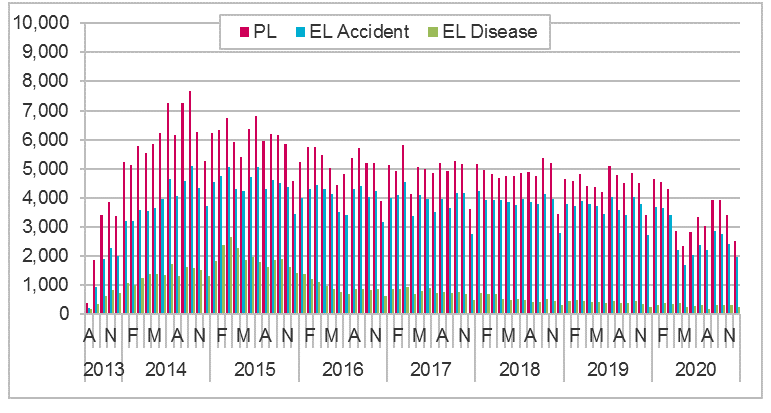

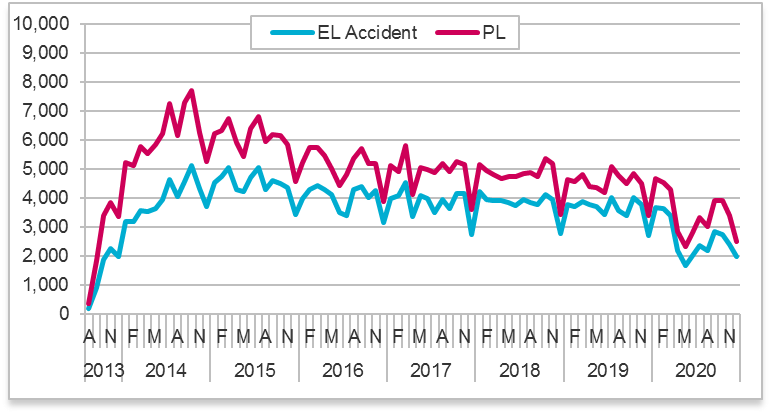

In December there were 1,977 EL CNFs submitted to the portal, the lowest figure since May 2020, this being 18.3% down on the prior month, and 27.3% down on the prior year. PL claims also dropped off with 2,510 new claims submitted, 26% down on the prior month and 26.4% down on the previous year. This no doubt reflects the November lockdown and many areas being under tier 3 and 4 restrictions in December:

The ongoing reduction in the rolling 12 month period can be seen in the graph below and we have commented above on the number of claims overall in 2020 compared to 2019:

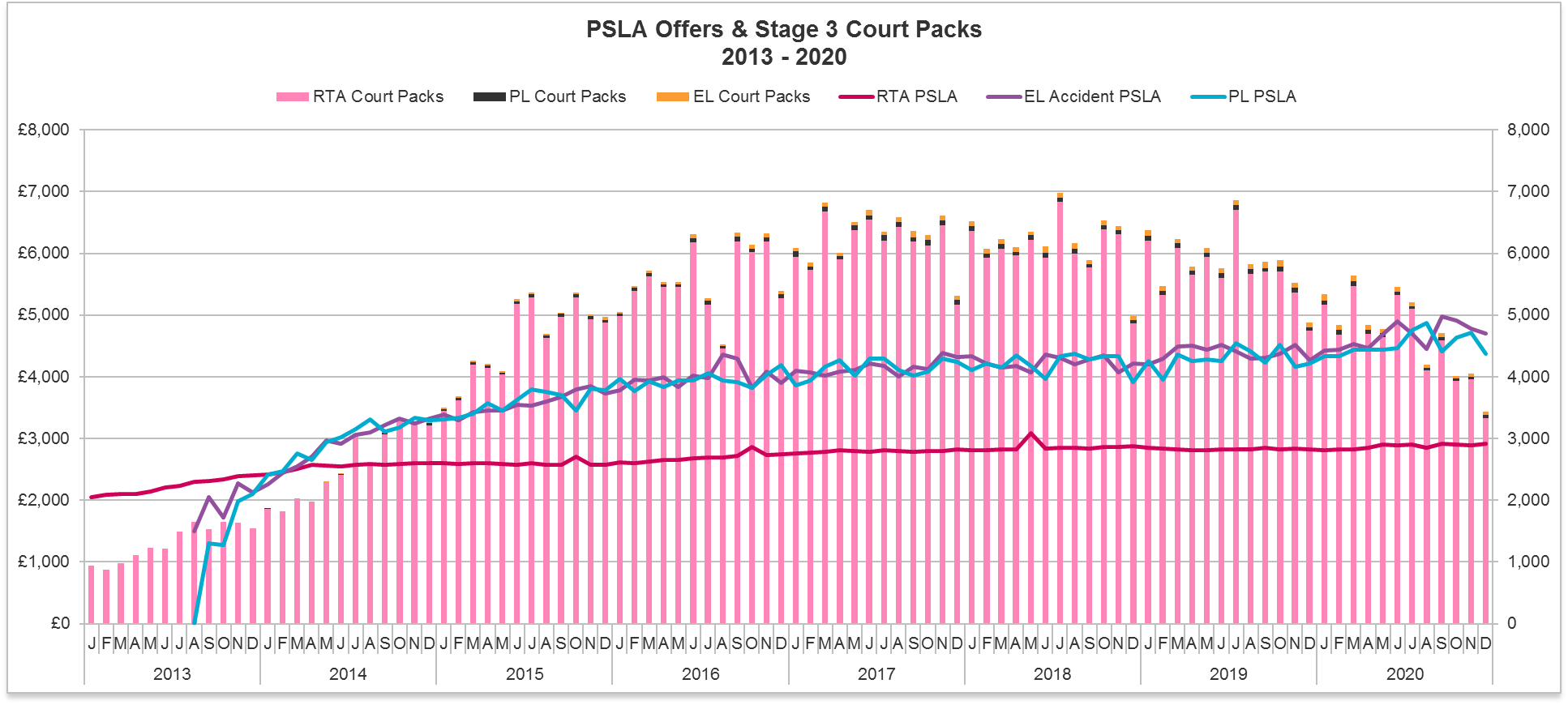

Court Proceedings Packs and PSLA

Again the lowest figure in CPP submissions in RTA case since 2014 was seen, just 3,331 packs being submitted. There are simply fewer claims in the system now due to the continuing pandemic, and that combined with increased collaboration and mediation between the parties shows in the figures.

There was a very small increase in PSLA in RTA to £2,917; EL and PL PSLA figures were down by small amounts overall this month:

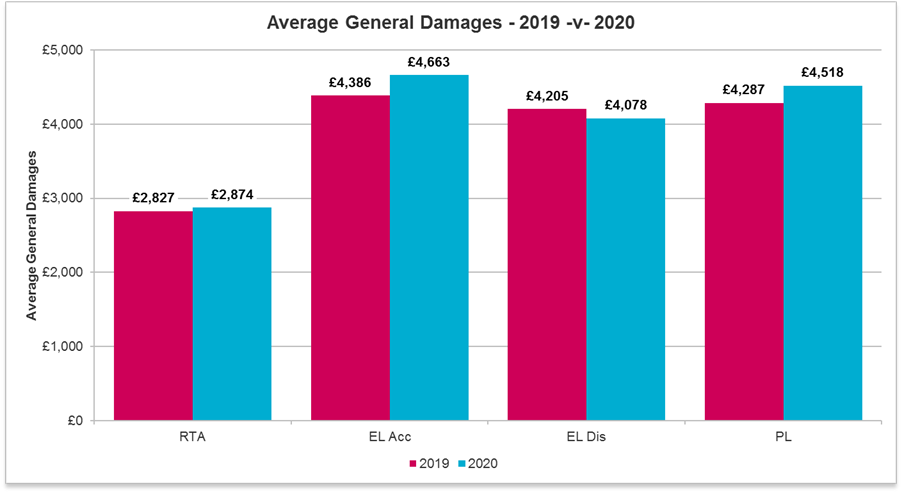

We also have figures for the annual average of general damages across the areas we look at, with RTA, EL Accident and PL showing small rises but EL disease falling:

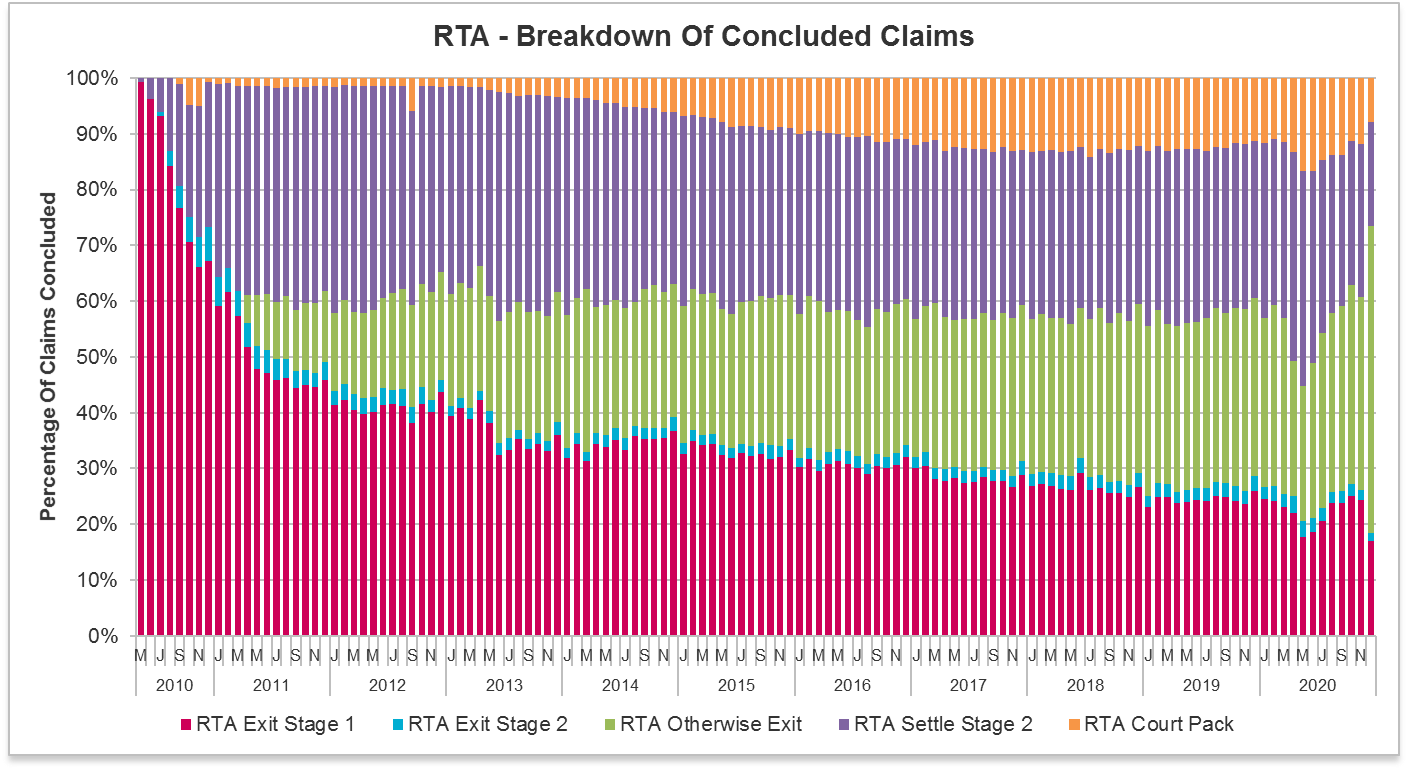

Retention

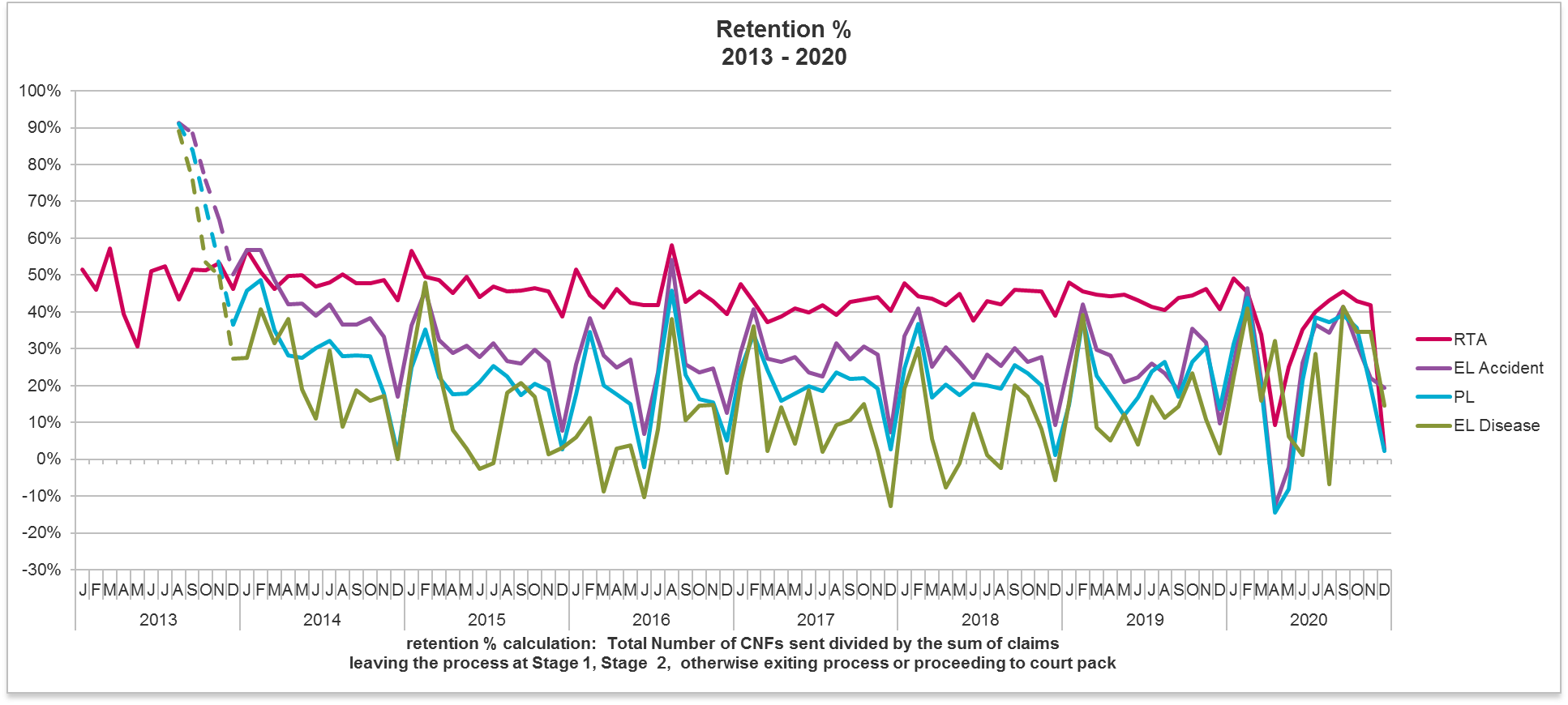

For some reason the December RTA statistics from Claims Portal show a significant increase in both the number and percentage of claims exiting the process for an unspecified reason which can be seen in this graph here:

The importance of that can be seen when we then look at the retention figures which have nosedived as a result. We are investigating whether there is any particular reason driving that for the month of December, but for the moment we would just urge some caution when considering the retention figures as a result:

And so as we look back on a year when claims frequency and severity was affected by a global pandemic that no-one foresaw, we look forward to seeing the additional effects of the whiplash reforms in 2021, along with the inevitable attempts to challenge and circumvent the new rules. The MOJ have also said once they are implemented they will then turn their attention to rehabilitation and credit hire which is still outstanding from part two of the whiplash consultation in 2016. We should also see the extension of fixed costs brought to fruition towards the end of the year, and maybe by then we will see the outcome of the e-scooter trials too. One way or another, it is unlikely to be a quiet year…