Well finally the big day has arrived and the MOJ has released the Pre-Action Protocol, Practice Direction and rule changes associated with the whiplash reforms.

Whilst the full detail of the text will take a little time to assimilate, we thought it would be useful to set out a summary of the key changes and headlines to help guide you through the new process. Links to the texts are at the end of this summary.

A little background

Hopefully most people are fully aware of the background, however as a reminder the reforms that will be implemented in May are broadly set out in the Civil Liability Act 2018. That in turn was based on various whiplash consultations from the MOJ and the proclamation from George Osborne back in 2015 as part of the Autumn Statement that whiplash would be "banned". The rationale was that motor premium costs are far too high and the cost of whiplash to policyholders amounted to an average of £90 per policy, and so by taking whiplash claims out of the system, every household paying a motor premium would save money.

Whilst ultimately, whiplash claims haven't been banned, the headlines from the Civil Liability Act are:

- An increase in the small claims limit for RTA claims for personal injury up to £5,000, subject to exceptions detailed below. This means that claims up to £5,000 in value will no longer be cost bearing and therefore, in theory, less attractive to claimant solicitors and claims management companies, or for fraudsters to put forward fraudulent whiplash claims.

- The introduction of a tariff for whiplash claims so there would no longer be arguments over the amount to be awarded because it would be fixed in law. The tariff itself is proposed to be at a very low level, for example a 0-3 month whiplash injury would be approximately £250 as opposed to the current £1,500, and so on. The tariff will however only apply to whiplash injuries and whiplash injuries with minor psychological injuries.

- A new portal system to be developed so that claimants can bring their insurance claims for personal injury directly, and do not need to use lawyers or claims management companies.

- A ban on pre-medical offers so that an insurer cannot make a pre-medical offer for whiplash and a claimant cannot ask for one. That is because pre-medical offers were seen as a driver of claims frequency and now every injury claim for whiplash will need to be substantiated with a medical report.

The detail then is set out in a new Pre-Action Protocol (PAP) for RTA claims "The RTA Small Claims Protocol", along with a new Practice Direction (PD27B) and consequential amendments to the Civil Procedure Rules. These have now been published.

We also have sight of the secondary legislation which includes regulations setting out the tariffs, the rise in the small claims limit and detail around the ban on pre-medical offers.

Who does it apply to?

The Act will only apply to accidents in England & Wales after the implementation date. That implementation date is 31 May 2021, and there will therefore be a considerable period where claims from accidents before that date will be treated differently to those after.

It does not apply to "vulnerable road users". Those are pedestrians, cyclists, motorcyclists, mobility scooter riders, and so on as set out in the PAP. Their claims will still be valued outside the tariff and subject to fixed costs and submitted in the current portal.

Infant claims are subject to the tariff, however they are not subject to the costs limitation and will be dealt with through the existing portal.

The current exemptions have been brought through to the new protocol for, deceased parties, bankrupts, and accidents involving vehicles registered outside the UK.

It only applies to injury claims and so claims for vehicle related damage will be dealt with outside the protocol, subject to various exceptions mentioned below. Claims for rehab payments, even where that has been provided by a third party and not paid directly by the claimant, will remain in the process as an item of injury related damages in the same way as now.

Unrepresented claimants

One of the first issues is around unrepresented claimants. Claimants will be permitted to use the new portal and indeed encouraged to do so. Although no advertising campaign has yet materialised for the general public, there will be an accompanying guide to making a claim aimed primarily at unrepresented claimants. Equally, the new portal will allow for representation by a claims management company, or indeed any other representative regulated by the FCA, as well as a solicitor of course. Insurance companies will still wish to, and be able to, deal directly with non-fault third parties. What is going to be new for insurers is dealing directly with unrepresented claimants where liability is in dispute and there will inevitably be concerns around the amount of operational resource that will take. An unrepresented claimant will have to submit the claim via the portal with the assistance where required of the Portal Support Centre. The claimant will also have to select their medical expert via MedCo and liaise directly with the expert/agency to arrange their appointment, although the letter of instruction will be automatically produced via the portal.

Liability disputes

The first point to note is that the insurer will have a longer period to provide a decision on liability in order that they can provide a meaningful response. The insurer will therefore have 30 working days to make a decision on liability (40 in the case of the MIB). Importantly, if the insurer does NOT make a decision within the timescale, then they are deemed to admit liability. Equally important, when the insurer denies liability in part or in full, they will need to provide their policyholder's version of events in the defendant's version of events form, setting out why they are denying liability and that will need to be supported by a statement of truth. This is a new process at this early stage and it will also impact upon policyholders because as well as detailing the circumstances of the accident at the outset, they are now likely to have to provide a statement of truth as to what happened, within 30 days. There is an alternative where if the insurer cannot for good reason obtain a statement of truth from the policyholder within the 30 day period they can provide a witness summary with a statement of truth signed by a representative of the insurer, but practically this will cause difficulties and will only provide a temporary respite until the contents of the court pack is responded to. Where there is a partial liability denial, a statement of truth will again be required by the policyholder. There will then be a process similar to stage 2 where liability offers can be traded up to three times between the insurer and the claimant.

Admissions

If liability is admitted or there is a deemed admission, then the PAP provides that the admission is binding on the insurer for the claimant's claim for personal injury and other protocol damages (not credit hire/repair). However, if these losses are not capable of agreement in the portal and the claimant issues proceedings, the repairs/hire (Non-Protocol Vehicle Costs (NVC)) must be included in the claim form, and the portal admission that binds the compensator extends to these losses also. There does however remain the ability for the insurer to withdraw the admission when causation is raised. Furthermore, the admission is not binding on linked claims such as passengers or a counterclaim. However, whilst that appears to be how the rules are drafted, there is concern that such an admission will at least be of evidential value in a separate claim and there may well be satellite litigation in this area.

Liability resolution process

Originally, the intention was that there would be a form of ADR contained within the process, at least for unrepresented claimants, but that fell by the wayside some time ago. Given the lack of ADR, a new process has been included whereby if the insurer denies liability in full and the claimant wishes to proceed with their claim they are at liberty to issue proceedings without a medical report in order to take the matter to a small claims hearing, obtain a decision on liability and, assuming some liability attaches to the insurer, then bring the matter back into the process and carry on with the claim in respect of quantum as detailed below. There is concern that the small claims process in respect of liability has elongated timescales and that will have an impact upon the lifecycle of the claim, and also potentially the recovery prognosis period if the claimant is waiting over a year before seeing a medical expert. Even with the expedited Part 27B process which dispenses with the need for directions questionnaires, hearing dates are likely to be a long way off. The small claims process in this instance will usually have standard directions, and although the parties can ask to rely on additional evidence they must explain why this evidence wasn’t disclosed in the portal process. It is envisaged that the evidence will already be taken from the details uploaded to the portal from both the claimant and the insurer, including the defendant's statement of truth. Hence the frontloading of evidence required within 30 days of the CNF. The hearing itself will be one where the parties are expected to attend in person so witnesses can be cross-examined, similar to a current small claims track hearing.

Fraud/causation

The insurer can allege fraud or fundamental dishonesty at any point in which case the claim will no longer proceed under the portal. If that is the case then the matter should fall into the existing Personal Injury Pre-Action Protocol, and when the claimant comes to issue proceedings it will usually be allocated to the fast track and costs limited to fixed recoverable costs, or fraud may potentially be multi track. In terms of causation, so specifically farmed and low speed impact claims, the insurer will now be able to indicate within the 30 day period that they are admitting fault but not admitting an injury was sustained and the claim will remain in the SCT portal. Where that happens the insurer's response should set out their policyholder's version of events and the medical expert must be told why the compensator disputes causation. The medical expert will be asked to comment on whether the accident caused any injury if the claimant or defendant's account is found to be true. Alternatively the insurer can wait until receipt of the medical report to review and raise causation. Where the claimant is unrepresented the insurer will always pay for the medical report, even if causation is disputed. If causation is raised at the outset once the claimant has disclosed the medical report the insurer can then decide whether they want to maintain the denial on the basis of causation, or deal with the claim. If causation remains in dispute or is raised after receipt of the medical report, then again the claim will drop out of the process and the claimant can abandon their claim or is at liberty to issue proceedings. The case on issue is likely to be allocated to the fast track and fixed recoverable costs will apply. Part 45 has specifically been amended to provide for fixed costs in cases that drop from the SCT portal, do not go into the RTA portal, and are not allocated to the multi-track.

Obtaining medical evidence

Medical reports will have to be obtained via MedCo as now. The MedCo process will apply to unrepresented claimants as well and MedCo has also been extended to apply to all types of injury where the value of the claim is under £5,000 rather than simply soft tissue. Every claimant will therefore need to obtain a MedCo report before the claim can be settled if an element of the claim involves whiplash. The claimant will receive a copy of the report and can then elect when to disclose that to the insurer as per the current process, but disappointingly if a further report is sought there is no requirement for the claimant to disclose the first report to the insurer before the subsequent report is obtained. A further medical report will only be justified where it is recommended in the first expert's report, further time is needed to determine the prognosis, the claimant is receiving treatment, or has not recovered in line with the prognosis. When the claimant is unrepresented the insurer must arrange and pay for the further report, sometimes without even having seen the first report.

Interim payments

Whilst the claimant can still request an interim payment for items of special damage and issue proceedings if there is a dispute over that, the automatic entitlement to an interim payment of £1,000 for PSLA upon disclosure of the first report and an interim settlement pack has gone. That seems to be a reflection of the MOJ's desire for this to be a swift process with only one medical report and for the vast majority to settle that way.

Stage 2

The second stage will be the quantum process, not too dissimilar to how the current portal works except for the thorny issue of valuing the PSLA for non-tariff injuries and the new requirement of a statement of truth on the insurer's offer. Where the claim falls within the tariffs, the medical report should indicate which bracket of the tariff it falls into. The insurer will effectively then not be making an offer, they will just be inserting the amount of the tariff into the response pack, and there will be no opportunity for negotiation on that. The claimant can request an uplift in exceptional circumstances. The procedure is that the claimant can advise at the outset, and to the medical expert, that they feel they are entitled to a 20% uplift on the tariff because of some exceptional circumstances. If the medical expert identifies those, then it will be on the medical report and the insurer can elect to make an offer up to the 20% or challenge it.

The tariff

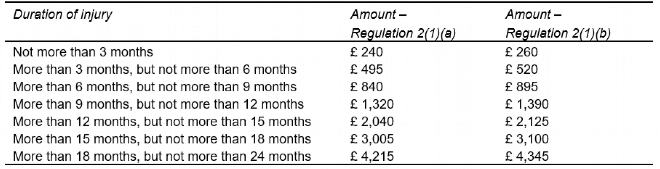

We now have details of the tariff and the most obvious change since the Civil Liability Act is the splitting of the tariff into two, as per one of the original proposals in the 2016 consultation. So there is one tariff for whiplash only and a second slightly increased tariff for whiplash with a minor psychological injury. In the table below, the first column is where there is purely a whiplash injury, and the second is where the whiplash injury includes one or more minor psychological injuries suffered on the same occasion:

As we have known for some time, the most difficult aspect is going to be when the claimant has non-tariff injuries as well as whiplash. In those circumstances, the whiplash will be valued by reference to the tariff, however the non-tariff injuries such as a bruised knee, banged elbow, etc. will be valued by reference to the current Judicial College Guidelines. On that basis, whilst a 0-3 month whiplash might be valued at £240, a 3 month bruised elbow could be worth £2,300 based on the Judicial College Guidelines. So where the tariff has been introduced to bring certainty, those claims falling outside the tariff will be anything but certain.

It is likely that there will be test cases taken to the Court of Appeal comprising a number of challenges, and the Court of Appeal will be asked to adjudicate on the process for valuing non-tariff injuries. However in the meantime this will be a complicating factor and an area of challenge because insurers will not want every case resting upon the outcome of a test case and will want to settle claims off in a fair manner without overpaying.

Another change at Stage 2 is in relation to NVC. Under the current process the claimant should not ordinarily include hire charges or vehicle damages, but that has been something that has crept up ever since Willis v Phillips was decided. In the new protocol, so called non-protocol vehicle related damages cannot be included. The claimant can only claim for the injury related damages and for any vehicle related damages where they are responsible themselves for paying them, e.g. a policy excess, or where they do not have cover and will be paying the total loss value of the vehicle or claiming it themselves.

As with the current portal, once the claimant submits their medical report and other protocol damages the insurer will have 20 days to make an offer, and then up to 3 offers and counter offers can be traded. The offers need to set out why items are not agreed and the reason for the counter offer. There are some important changes so that the first offer comes from the insurer and now needs to also include a statement of truth from the insurer.

The court process for quantum

Importantly, the requirement for an insurer to pay the amount of their last offer at the start of the stage 3 process, the court proceedings pack, has been removed. This means that a claimant can no longer elect to take the money on offer AND still proceed to a stage 3 hearing. If they don't accept the offer, then given the current state of the civil justice system they may have to wait some time…

Other than that save where there are vehicle related damages as below, the stage 3 process for quantum is not greatly different to now, assuming liability has been dealt with.

If partial liability is still outstanding as well as a quantum issue, then the matter will need to go off for effectively a small claims hearing to determine liability and quantum.

If liability has been admitted or agreed then the hearing will only be in respect of the quantum element. Then it will be similar to the current process but even if the claimant asks for a paper hearing the defendant can request an oral hearing.

Vehicle related damages

Whilst we have noted that NVC are excluded previously, if the claimant has to issue proceedings they will need to check whether there are any other outstanding vehicle repair and hire charges. If there are, then they need to be added to the portal claim prior to proceedings being issued. The claimant completes and uploads onto the portal the NVC claim document and evidence in support, and within 15 working days the insurer completes the NVC response document.

If there is a claim for hire and proceedings are issued, then standard hire directions will be given and the matter will be listed for a small claims hearing (assuming the value of the claim as a whole remains under £10,000) where the claimant needs to attend and can be cross examined rather than a stage 3 hearing.

What next?

The next significant milestone will be completion of the screens for the Official Injury Claims Portal. The MIB have a further webinar arranged for 2nd March to update on the final build and delivery work ahead of launch. Seeing the screens to accompany the rules will of course be crucial for training programmes.

Links to the new provisions

The draft Regulations including the tariffs can be found here: The Whiplash Injury Regulations 2021

The links to the new Pre-Action Protocol and Practice Directions can be found on the Civil Procedure Rules homepage, or you can go straight to the documents:

For those looking for even more detail, see the Commencement Order and consequential rule changes: