Introduction- the context

The pandemic has placed unprecedented pressure on the NHS and the social care network that supports it. The challenges of freeing up NHS beds by ensuring suitable discharge arrangements for those patients who require social care post discharge is nothing new ('bed blocking' is a term that has been known for over a decade) but, in the context of a highly infectious and deadly virus, particularly in the elderly, successful management of that problem became part of the national emergency and required a new strategy, hence the Designated Setting Scheme.

What is the Designated Settings Scheme?

The UK Government's Adult Social Care: Coronavirus (COVID-19) Winter Plan 2020-2021 recognised the need to:- Prevent and control infection spread

- Achieve collaboration between health and care providers

- Support receivers and givers of social care

- Support the system behind the care network

This promoted a recognition that there was a need for 'safe places' for people who were fit enough to leave hospital, needed to receive social care but had tested positive for COVID-19.

The result was the creation of the Designated Settings Scheme supported by the Care Quality Commission (CQC) to ensure that anyone discharged from hospital who was COVID-19 positive and needed care home support was only discharged to a facility that met specific standards.

How does a Care Home qualify as a Designated Setting?

The qualifying requirements involve having in place additional policies, procedures, equipment, staffing and training to protect residents, staff and minimise as much as possible infection risks. In addition, a CQC inspection must have been carried out to confirm their latest infection prevention standards have been met. Residents are required to undergo 14 days isolation in such a setting before relocation. It is the responsibility of the Local Authority to ensure that there are sufficient Designated Settings 'switched on' to cope with the discharge of such COVID-19 positive patients from hospital.

Care home providers are also required to ensure that they have sufficient insurance cover to provide such services – it was this requirement that has led to the establishment of a government backed indemnity scheme as set out below.

Insurance and Indemnity for a Care Home qualifying as a Designated Setting

Care England (the largest representative body of independent adult social care providers) issued a letter to the Prime Minister in 2020 highlighting that as the majority of care homes were in the independent sector (and therefore did not qualify for NHS Indemnity) obtaining insurance to function as a Designated Setting was a barrier to homes being able to join the scheme.

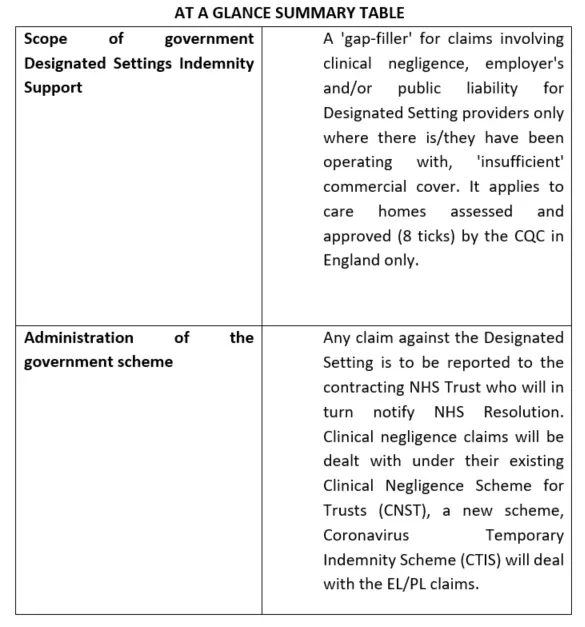

On 18 January 2021 the Vaccine Deployment Minister (MP Nadhim Zahawi) acknowledged the role of the insurance industry in continuing to provide cover but in recognition of the challenges announced that a state backed indemnity scheme for care homes registered as a 'Designated Setting' would be available to those who were unable to obtain 'sufficient' cover on the open market to operate between 19 January 2021- 31 March 2021 inclusive and for 14 days after 31 March to cover any patients discharged to a Designated Setting on 31 March 2021.The scheme is not retrospective and is due to be reviewed mid-February.

What does this all mean for Insurers and Care Home Providers?

As set out above, the scheme remit is narrow in scope and duration. As the FAQ's on the NHS Resolution website demonstrate, it is a scheme to 'bridge a gap' – as a result, if a provider is able to obtain commercial insurance to cover their operational risks then that will apply. If, however, there is a gap then, subject to approval from the Department of Health and Social Care, the Indemnity Support scheme will apply. It remains to be seen how this interplay of 'top up' will play out, as at 28 January 2021 there were 151 CQC approved Designated Settings spread out across 105 Local Authorities. There is much speculation that following the wave of infection, a tsunami of claims is coming. Claims Management Companies (pre-existing and many set up purely to deal with COVID-19 cases) are open for business but there are hurdles including coverage and causation that will need to be addressed in the coming months. Like the vaccine, the announcement of the indemnity support scheme is 'good news' but it has limitations and as ever, the devil is in the detail.

For further information please contact Vicki Swanton.