HY23 HIGHLIGHTS

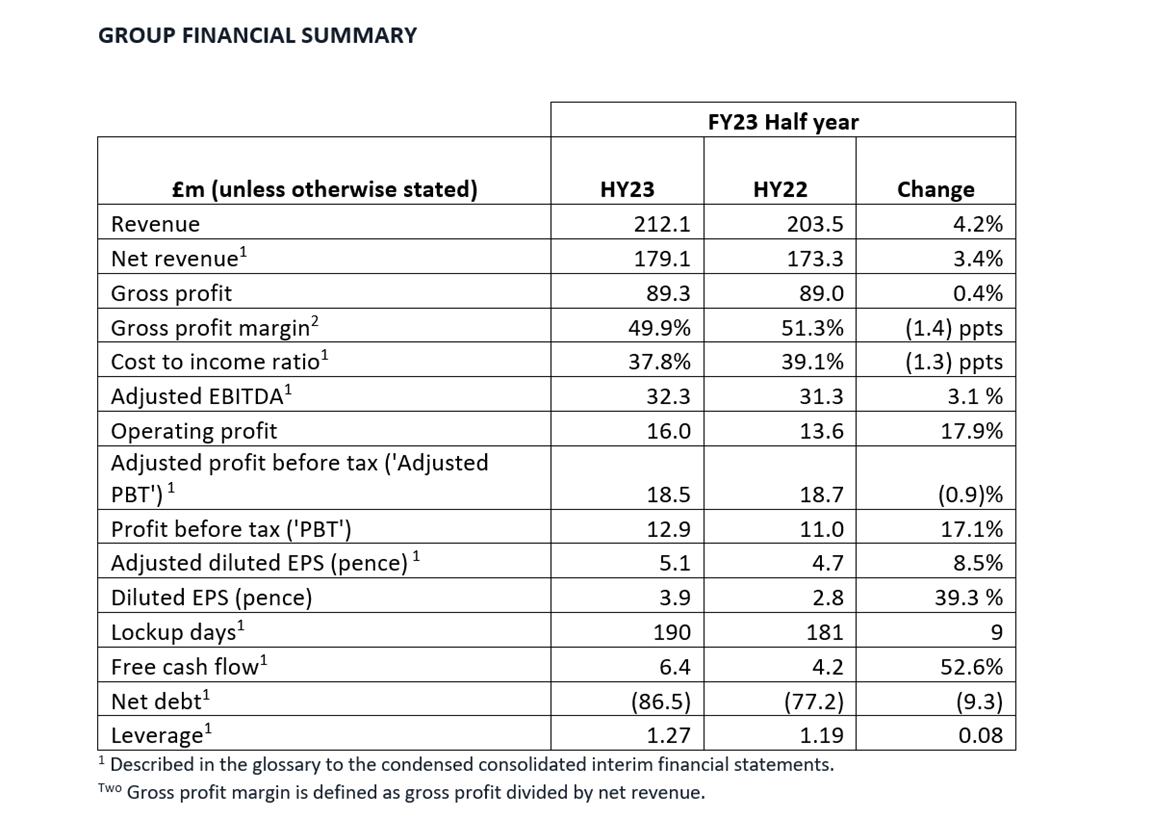

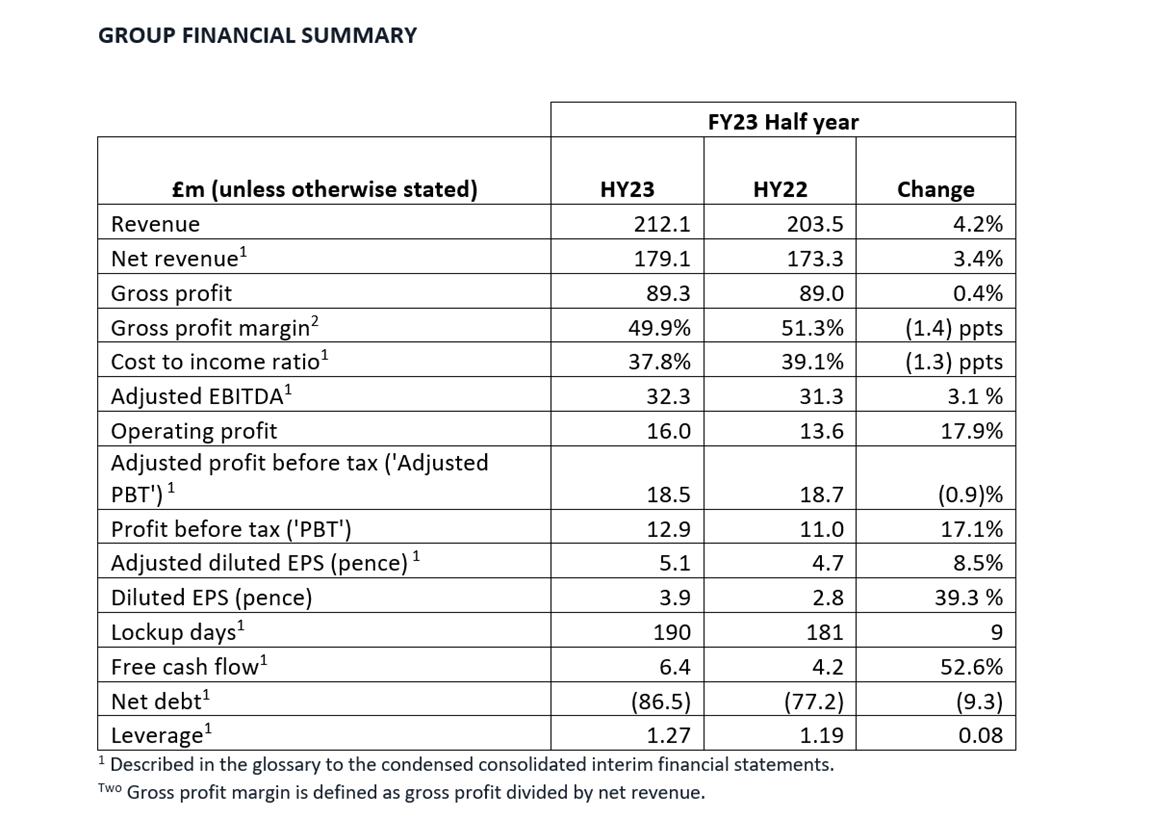

- Group net revenue growth of 3.4%, (organic growth of 3.1%), to £179.1m:

o 4% growth in Legal Advisory

o 16% growth in Connected Services

o 17% contraction in Mindcrest following a reorganisation and with recent investment in sales resource which is generating pipeline for future growth

- Gross margin of 49.9% reflects continued salary pressure in the sector, which is offset by cost to income ratio improvement of 1.3ppts with strict overhead control mitigating direct cost pressure.

- Adjusted PBT of £18.5m versus a strong prior year comparator of £18.7m

- Reported PBT is £12.9m, which is a £1.9m (17.1%) improvement on the prior year. This is due to a lower level of adjusting items in the period of £5.6m comprising mainly of share-based payment charges from the partner-funded employee benefit trust and acquisition related expenses.

- A nine day (5%) increase in lockup days versus prior year reflects the Group's ongoing focus on efficient working capital management which has mitigated the impact of a sector wide lockup trend where the average increase in lockup days for the top 11-25 firms is reported (in the 2022 PwC Law Firms' Survey) to be an 11% increase.

- HY23 free cash flows of £6.4m reflect a £2.2m or 53% improvement on the prior year as the Group continues to improve cash generation now that Covid, restructuring and acquisition deferrals have been paid down.

- Net debt of £86.5m is higher than prior year due to the stretch in lockup days, which is expected to partially reverse in H2.

- Leverage remained stable at 1.27x adjusted EBITDA (HY22: 1.19x), reflecting improving profit offsetting increased lockup days and net debt.Net revenue per partner¹ increased by 1% to £492k (HY22: £488k).

STRATEGIC HIGHLIGHTS

The Group continues to make good progress in line with its strategy:

- Capturing compelling M&A opportunities with the acquisition of Acumension to support growth in Connected Services Costs business, and the Whitelaw Twining transaction in Canada. This transaction bolsters the Group's position in North America and in the global insurance market with significant client overlap and anticipated revenue and cost synergies.

- Ongoing efficiency programme with the aim of removing £10m to £12m of cost, with this annualised run rate expected to be achieved by the end of FY24. Cost savings via property reduction, central function savings and proactive resource management will help to offset gross margin pressure and strengthen outer year (FY25 onwards) performance. The one-off cost to achieve the savings is expected to be £3m.

- Focussed on attracting and retaining top industry talent, with Legal Advisory recruiting 14 new partners globally and promoting nine people to partnership.

- Good progress on key legal panels, with the Group securing more than 30 panel appointments, with the top 10 by value worth annualised revenue of £30m, each with a minimum contract term of three years.

OUTLOOK AND CURRENT TRADING

•

The strong trading in H1 is expected to continue in the second half of FY23, with a shift expected between transactional work and our more counter-cyclical litigation and regulatory practice areas.

•

As is typical, the second half is also expected to benefit from the higher weighting of revenues, in line with historical averages, whilst costs are flat or in some cases being managed downwards.

•

The Group remains on track to deliver adjusted PBT in line with market expectations, adjusted for an additional £1m of interest costs due to unexpected base rate increases.

•

The Board has approved an interim dividend of 1.6p per share, reflecting the stated policy of paying an interim dividend that is one third of the PY full year dividend.

Sir Nigel Knowles, Group Chief Executive Officer, commented:

"We are pleased with our strong first half performance, achieved against a challenging macro-economic backdrop. Net revenue is up by 3.4% and adjusted profit is in-line with a stellar prior year. We have won some significant mandates and retenders reflecting our deepening relationships with key clients and we have extended our capabilities, both through strategic M&A, including our recent transaction with Whitelaw Twining in Canada, and new partner recruitment.

"This performance is thanks to the steps we have taken over the last two years to make our business more sustainable and future focused. We have defined a clear strategy built around integrated legal and business services and enhanced our core strengths, such as our expertise in insurance.

"We are taking proactive steps to maximise efficiency in this economic environment. We are well underway with an efficiency programme, through which we aim to remove £10m to £12m of costs by the end of FY24. This will enhance our efficiency as a business and support our strategy of pursuing profitable growth. In line with our purpose, this will enable us to continue to deliver positive outcomes with our colleagues, clients and the communities in which we operate.

“As we look ahead, we see the benefits of having both a global footprint and an established but diversified set of services through which we can provide solutions to our clients. Given the clear counter cyclical qualities of many of our services, such as our litigation and regulatory offerings, and the short to medium term benefit we will see through our efficiency programme, we maintain confidence in the outlook for the second half and beyond."

The person responsible for making this announcement on behalf of the Company is

Chris Stefani, Group Chief Financial Officer.

For further information

DWF Group plc

James Igoe - Head of Communications

+44 (0)7971 783533

H/Advisors Maitland

Sam Turvey +44 (0) 782 783 6246

Sam Cartwright

To view the full RNS click here

Australia

Australia

France

France

Germany

Germany

Ireland

Ireland

Italy

Italy

Poland

Poland

Qatar

Qatar

Spain

Spain

UAE

UAE

UK

UK