HY22 HIGHLIGHTS

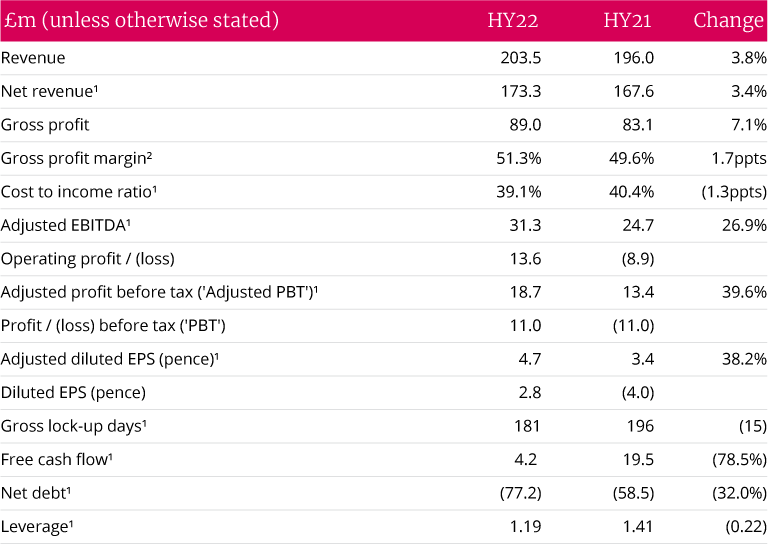

• Group net revenue growth of 3%, (7% on a like-for-like³ basis), to £173.3m:

2% reported growth in Legal Advisory, with like-for-like growth of 7%

14% growth in Connected Services (7% organic)

8% growth in Mindcrest (all organic)

• Gross margin increase of 1.7ppts from 49.6% to 51.3%, with all three divisions showing revenue growth, gross profit increase and gross profit margin enhancement.

• Adjusted PBT up 40% to £18.7m and a continued downward trend in cost to income ratio dropping by 1.3ppts versus HY21 to 39.1%, reflecting profitable revenue growth and the benefits of previously announced cost reduction measures and restructuring.

• Reported PBT is £11m, which is a £22m improvement on the PY loss before tax. This is due to a much lower level of adjusting items of £7.6m comprising mainly of share-based payment charges from the partner-funded EBT.

• A 15 day (8%) reduction in lock-up days versus PY (and a five day, or 3%, reduction on April 21) reflects ongoing Group-wide initiatives to improve working capital efficiency.

• HY22 free cash flows of £4.2m are after the repayment of £5.4m of COVID deferrals (VAT deferred under the UK government scheme). The HY21 free cash flow comparator of £19.5m benefitted from £9.5m of COVID deferrals (deferral of VAT and other taxes).

• Net debt of £77.2m is higher than PY due to the repayment of COVID deferrals, settlement of deferred consideration and a one-off outflow for the restructuring of Australia, with combined LTM (last twelve month) outflows of £24.8m incurred on these items.

• Total remaining COVID deferrals and deferred consideration at the October 21 balance sheet date are £6.3m compared to £12.4m at April 21 and £17.5m at October 20.

• Leverage has reduced to 1.19x adjusted EBITDA (HY21: 1.41x), reflecting the downward trajectory signposted in earlier guidance.

• Net revenue¹ per partner increased by 9% to £488k (HY21: £446k).

STRATEGIC HIGHLIGHTS

• The Group continues to make good progress in line with its strategy:

- The differentiated client proposition of providing integrated legal and business services through the Group's three divisions of Legal Advisory, Connected Services and Mindcrest continues to generate new business. During HY22, this Integrated Legal Management approach of providing services from two or more divisions has gained further traction with a year-on-year increase in both the number of clients and percentage of fees generated from such clients.

- The Group's Net Promoter Score (NPS) is now 63, up from 49 in our last client census. This evidences a loyal client base driven by high levels of satisfaction with service delivery and quality. The metric is used across industries and is derived from the proportion of clients who score DWF a '9 or 10' (on likely to recommend), minus those who score a '1 to 6'. It is based on responses from more than 500 clients globally.

- Management is increasing its focus on growth in Mindcrest and Connected Services over the medium term, through a combination of organic growth opportunities and potential M&A. The Group is investing in high quality scalable processes, technology and infrastructure in Mindcrest which has delivery centres in Pune, India and Chicago, US and will enable the Group to improve its operational gearing in the future by delivering the right work at the right level in the right location.

- A new ESG strategy has been announced today setting out long term carbon reduction and Diversity and Inclusion targets.

- The global "one team" culture has continued to gain traction, with the Group's latest Pulse Survey seeing an increase of 1 percentage point in the overall engagement index (76) since the last survey in December 2020 demonstrating that the Group's values and behaviours are well embedded.

- M&A remains central to the Group's strategy. The bolt-on acquisitions of BCA and Zing in HY22 have contributed to the strong growth in Connected Services. Management continue to identify a number of potential future M&A opportunities for the Group.

- The recently announced launch of a regional headquarters for business services in the Kingdom of Saudi Arabia, and an exclusive association with local law firm Al-Ohaly & Partners, is already producing a strong pipeline of new business opportunities in the Middle East.

OUTLOOK AND CURRENT TRADING

• The strong trading in HY22 is expected to continue in the second half of FY22 as the legal sector enjoys sustained demand for services, with the second half also expected to benefit from the normal marginally higher weighting of revenues. The Group remains on track to deliver in line with medium term guidance.

• The Board has approved an interim dividend of 1.5p per share, reflecting the stated policy of paying an interim dividend that is one third of the PY full year dividend.

Sir Nigel Knowles, Chief Executive Officer, commented:

"We are delighted with our performance for the first half of FY22. We have continued to see strong revenue growth on a like-for-like basis, after the decisive action taken in the prior year to exit or slim down a number of businesses. We have seen an improvement in our gross margin and a reduction in our overheads relative to revenue. This has led to a compelling step-change in profitability with our adjusted pre-tax profit increasing by 40%. Our client proposition of providing integrated legal and business services is gaining traction and leading to a strong pipeline of instructions."

"I am also pleased that today we have announced our group ESG strategy, which aligns with our purpose to deliver positive outcomes with our colleagues, clients and communities. The strategy includes new and stretched targets focused on climate action and further improving our diversity and inclusion performance. We want to build on our established programmes to become the market leader in ESG and we believe that the strategy announced today creates a firm foundation to help us achieve our targets. "

The person responsible for making this announcement on behalf of the Company is Chris Stefani, Group Chief Financial Officer.

To view this RNS in full detail please click here.

For further information

DWF Group plc

James Igoe - Head of Communications

+44 (0)7971 783533