FY2021/22 HIGHLIGHTS

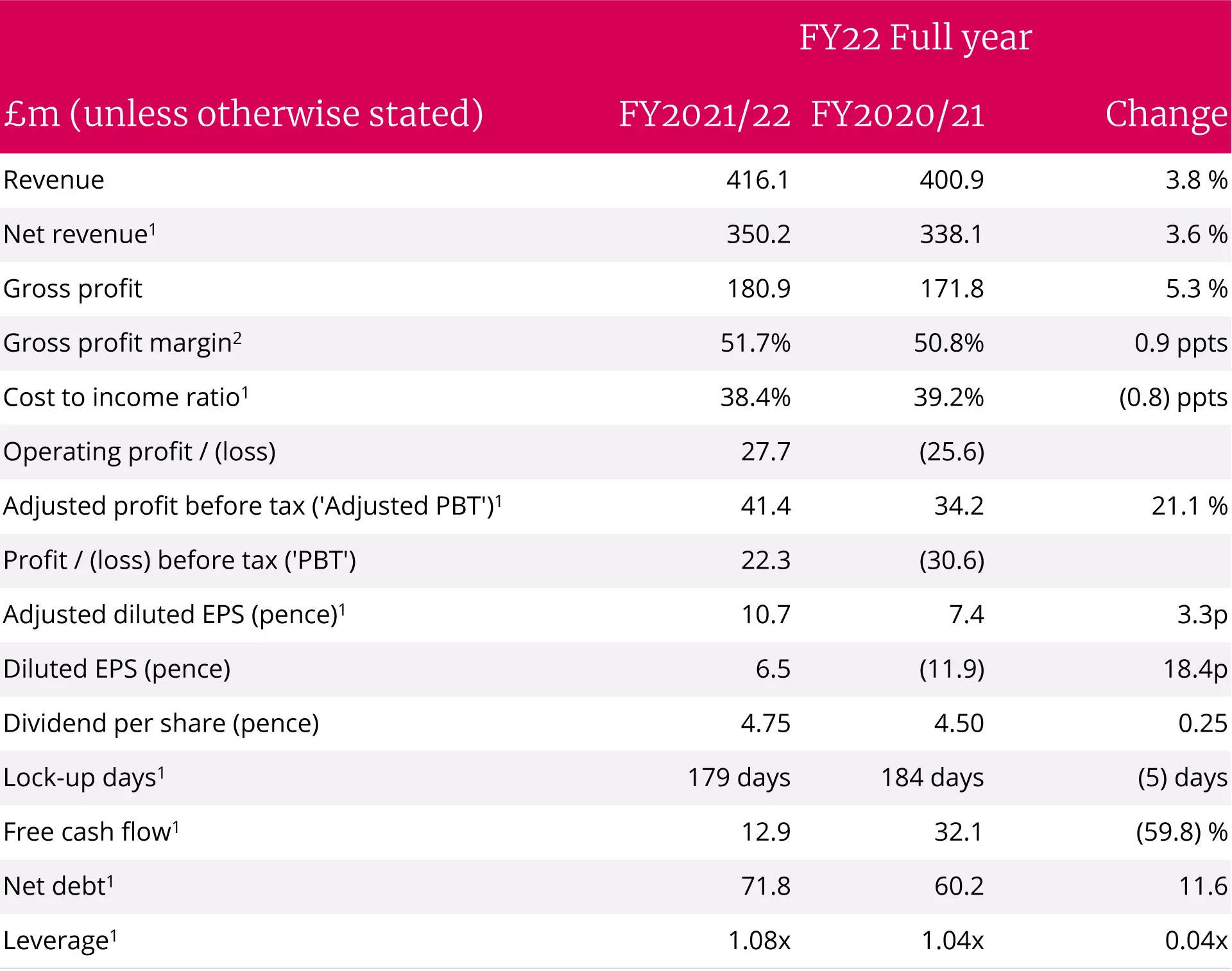

- Group net revenue growth of 4% (7% like-for-like)3 to £350m. Reported revenue growth of 4% to £416.1m.

- Gross margin improvement to 51.7% (FY21 50.8%) reflecting delivery efficiency and pricing.

- Cost to income ratio improved by 0.8ppts versus FY21 to 38.4%, now just 0.4 percentage points higher than the medium term guidance issued in July 21, targeting 38%.

- Adjusted PBT up 21% to £41.4m, reflecting the sustainability of top line growth, gross margin improvement and cost control demonstrated over the previous three reporting periods.

- Adjusted PBT margin of 11.8%, an increase of 1.7 percentage points on FY21 and 6.7 percentage points ahead of FY20.

- Reported PBT of £22.3m (FY21 loss of £30.6m), which differs to Adjusted PBT due to adjusting items of £19.1m (FY21 £64.8m).

- Adjusted diluted EPS of 10.7p (FY21 7.4p) a 44.6% increase on prior year and 0.7p (7%) ahead of expectations.

- £12.9m free cash flow generated (FY21 £32.1m) after repayment of all remaining COVID-19 VAT deferrals of £10.7m. Adjusting for timing would give an underlying FY22 position of £23.6m. This compares to free cash flow of £32.1m in FY21 which was a period that benefitted from cash inflows from a significant lock-up day decrease of 20 days.

- Net debt of £71.8m is £11.6m higher than FY21 due to repayment of COVID-19 VAT deferrals and acquisition related payments, and has reduced from HY22 by £5.4m, highlighting the Group’s cash generation. Leverage is broadly flat at 1.08 x EBIDTA (FY21 1.04).

- Balance sheet liabilities relating to deferred consideration and COVID-19 deferrals are £0.9m (FY21 £16m) reflecting a robust year-end balance sheet position.

- A 5-day (3%) reduction in lock-up days versus FY21 reflects continued progress on Group-wide initiatives to improve working capital efficiency.

- Net revenue per partner1 increased by 6% to £975k.

STRATEGIC HIGHLIGHTS

- New 3-division operating structure fully embedded to provide a platform for sustainable, profitable growth.

- Two acquisitions in Connected Services have bolstered an already very strong organic trajectory and there is a significant pipeline of M&A opportunities to explore.

- Property strategy under review with an estimated 1/3rd of global office space considered as potentially surplus to requirements post-COVID, representing a c£7m recurring annualised saving opportunity in the medium term.

- Client stratification and pricing initiative launched to ensure key client requirements are fully understood and priced appropriately.

- An increasing number of our clients now receive services from two or more of Legal Advisory, Connected and Mindcrest, representing a proof point for the Integrated Legal Management Strategy.

- Wins in FY22 include the UK central government legal services panel, NHS Resolution, Allianz and LV=.

OUTLOOK AND CURRENT TRADING

- The first two months of trading for FY23 have been strong, showing continued momentum in line with Q4 of FY22.

- Whilst the Board is mindful of inflationary pressures and the wider economic backdrop, DWF has resilient revenues, a countercyclical litigation focus, and recurring revenues in insurance providing a natural hedge against economic headwinds. We remain well placed to continue delivering on our growth strategy and confident in our medium-term guidance.

- Execution of the property strategy is expected to make a material contribution towards cost control for FY23 and FY24, with other back office initiatives offering potential for further operating efficiencies.

- For FY2021/22, the Board has declared a final dividend of 3.25p per share, taking the total dividend for the year to 4.75p, reflecting a pay-out ratio of 44% of adjusted profit after tax. This pay-out ratio reflects a progressive dividend in absolute terms, but retains a proportion of FY2021/22 profits to invest in near-term growth opportunities.

Sir Nigel Knowles, Chief Executive Officer, commented:

"We are delighted with the progress we have made this year. We have achieved a record set of results with net revenue growth taking us to £350m in scale, adjusted profit before tax up by 21% to £41m and lock-up days continuing to fall, down to 179. Our adjusted diluted earnings per share are up by 45% to 10.7p with our diluted earnings per share increasing to 6.5p, our strongest results since IPO.

"These results have been made possible through the continued transformation of our business, not least the successful implementation of our new global operating model which was introduced on 1 May last year. As anticipated, this has resulted in the greater integration and alignment of our colleagues and services, for the benefit of our clients. It has also supported our integrated legal management approach, our key differentiator which is helping us to gain share of wallet against both traditional and new competitors.

"Despite the prospect of challenging macro-economic conditions, we remain confident in our medium-term guidance. This confidence is supported by the defensive nature of the Group's revenue being weighted towards litigation and the recurring revenue base in Insurance, which has always protected the Group both from artificial peaks in growth and hedges against a slowdown in transactional activity. Similarly, we are confident that our balanced approach of competitive reward, including our unique ability to offer share awards, combined with a more progressive working environment will position us favourably in the 'war for talent'."

The person responsible for making this announcement on behalf of the Company is Chris Stefani, Group Chief Financial Officer.

For further information

DWF Group plc

James Igoe - Head of Communications +44 (0)7971 783533

Maitland / AMO

Sam Turvey +44(0)20 7379 5151

Sam Cartwright

Full RNS available to view here.