In more micro than macro terms, much has changed in our legal landscape as well, not all for the better. Court delays are worse than ever and the condition of the court estate leaves a lot to be desired. Against that the digitalisation process has well and truly started with the birth of the DCP and the OCMC. ADR has been made mandatory for some matters and it is hoped this will settle at least a percentage of cases and avoid trial. We now have the OIC and whiplash tariff, indeed that is approaching the first review already! The pace of change in our sector is not letting up!

What does the UK look like approaching 4th July 2024?

Employment

June 2024 figures have just been released. The employment rate of 74.3% is below forecasted figures, the unemployment rate of 4.4% above – the pre-pandemic figure stood at 4.1% in February 2020, just after the December 2019 election so unemployment has risen by 0.3% over the course of this Parliament. The economic inactivity rate currently stands at 22.3% and increased in the last quarter. Those claiming benefits related to unemployment rose to 1.629 million at the most recent count. Understandably, the highest figure in recent times was during and just after the pandemic.

Perhaps a better idea of how things have been since 2019 comes from the percentage of people in employment:

Some of this drop will come from an aging population and preventing legal migration will not assist rates unless those currently on benefits or unable to work due to disability are brought back into the working population. This is no easy process.

Inflation

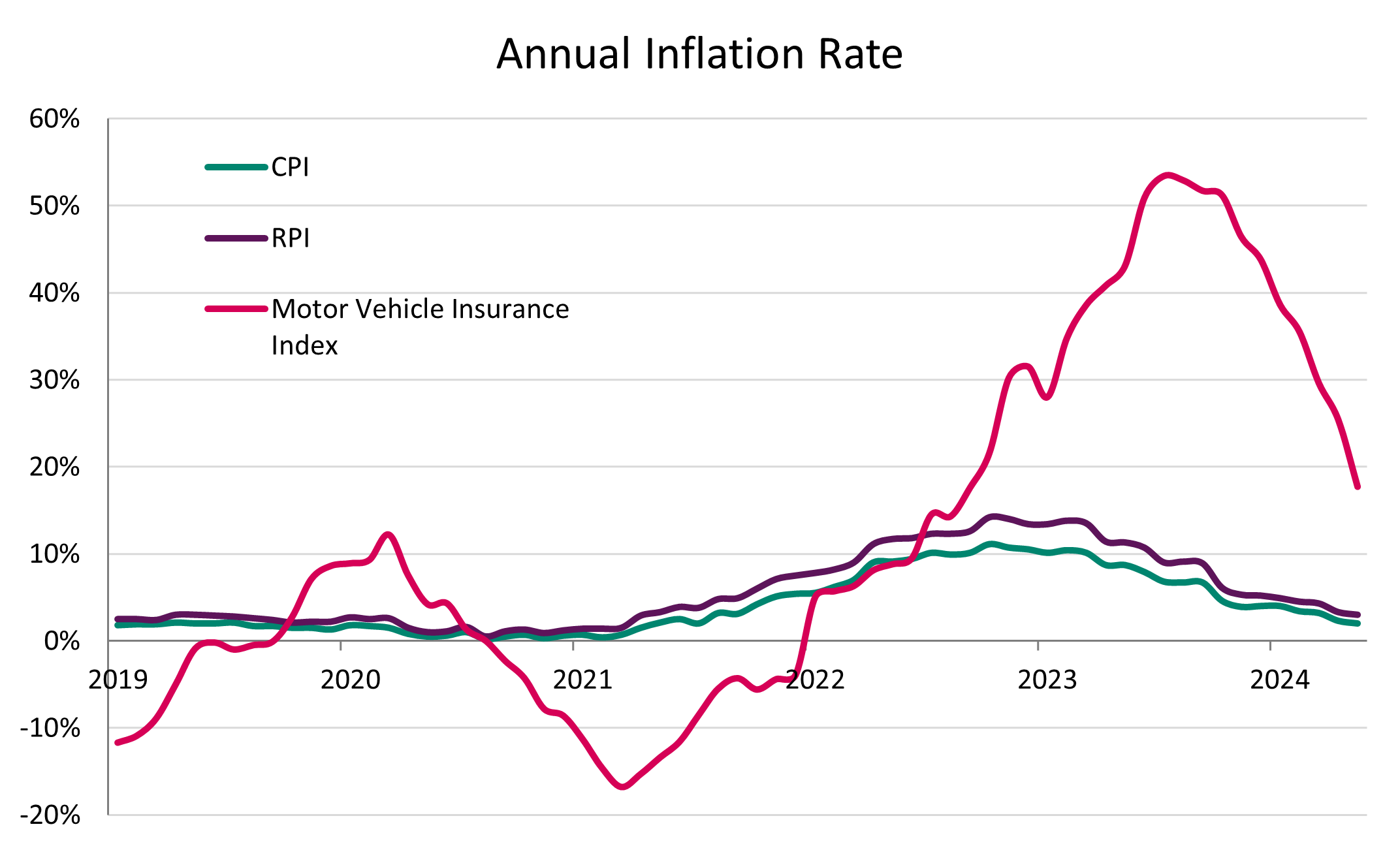

At the point of the last election in December 2019, inflation stood at 1.4%. Today it stands at around 2%, which is back on target for the government. Inflation peaked at 11% in 2022 and interest rates have been higher over the last few years to tackle this inflationary pressure. Causes of inflation include supply chain issues caused by Brexit and the war in Ukraine. Interest rates remain high but are expected to drop by the end of the summer:

Claims Inflation

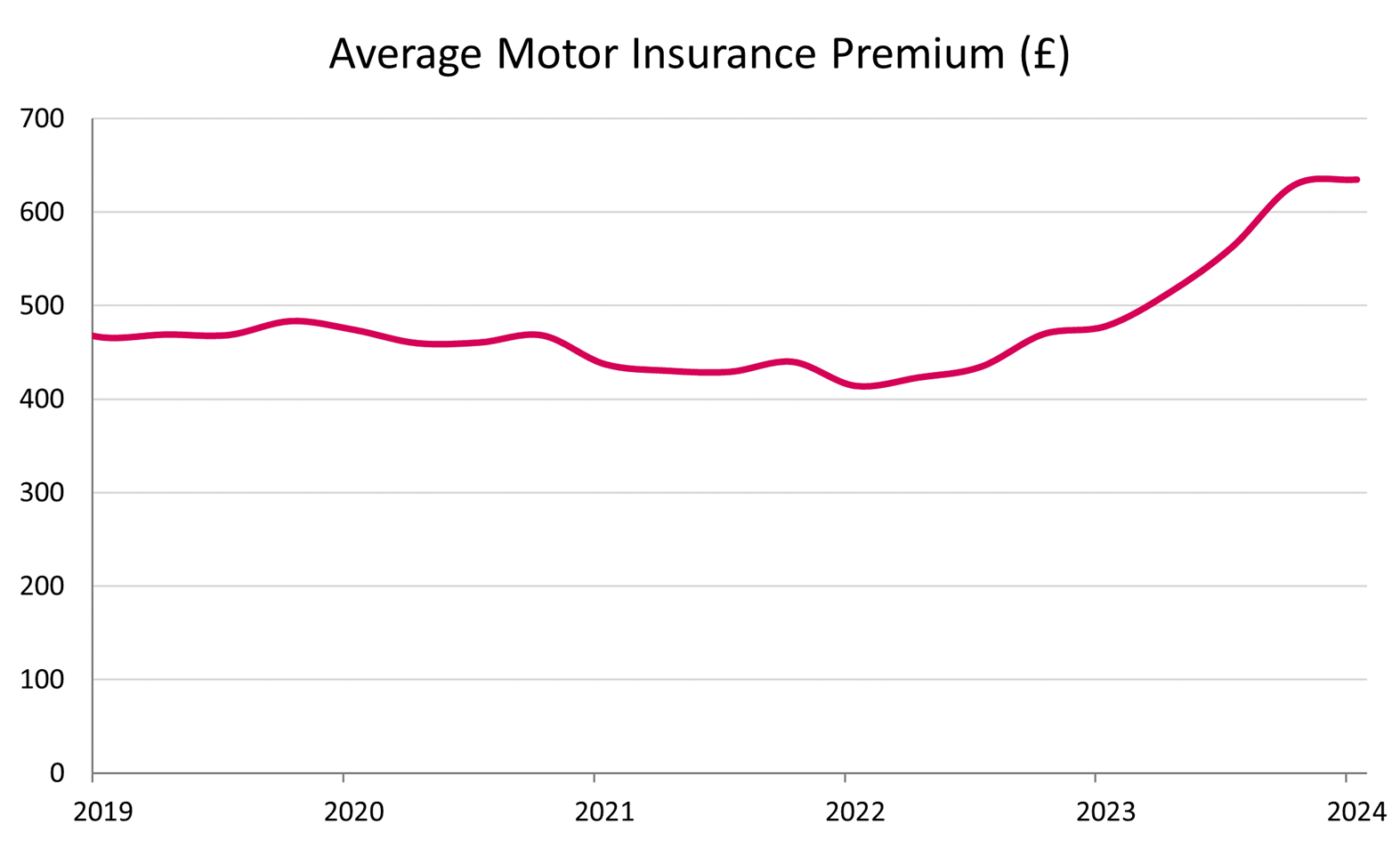

Of course, inflation in general puts pressure on goods and services. This leads to a knock-on effect on the cost of claims, especially in the multi-track arena. If somebody needs full time care, this care is more expensive both in terms of items required and staffing. Salaries are rising and loss of earnings/future loss claims inevitably increase exponentially. The cost of living crisis has not helped either, with food prices rising rapidly. The average motor premium has now levelled out, however:

Industry developments will also flame claims cost inflation. We await the conclusion of the discount rate review which should come within months of the change of government and the whiplash tariff review. Both events could make claims more expensive again. The picture appears to be one of the frequency of claims dropping overall but the amount paid on individual claims rising, balanced by the non-cost bearing OIC process.

Transport

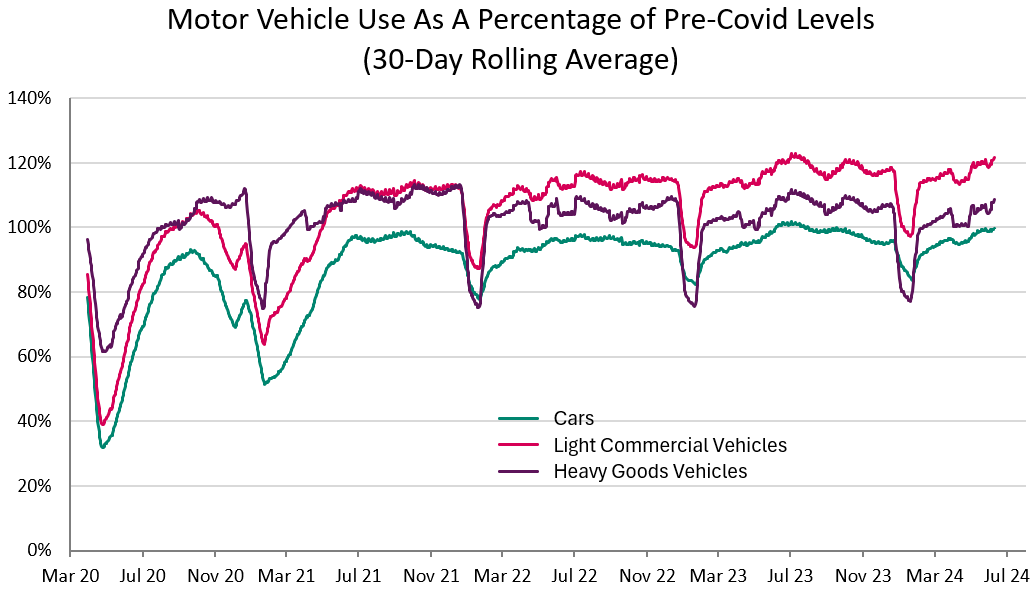

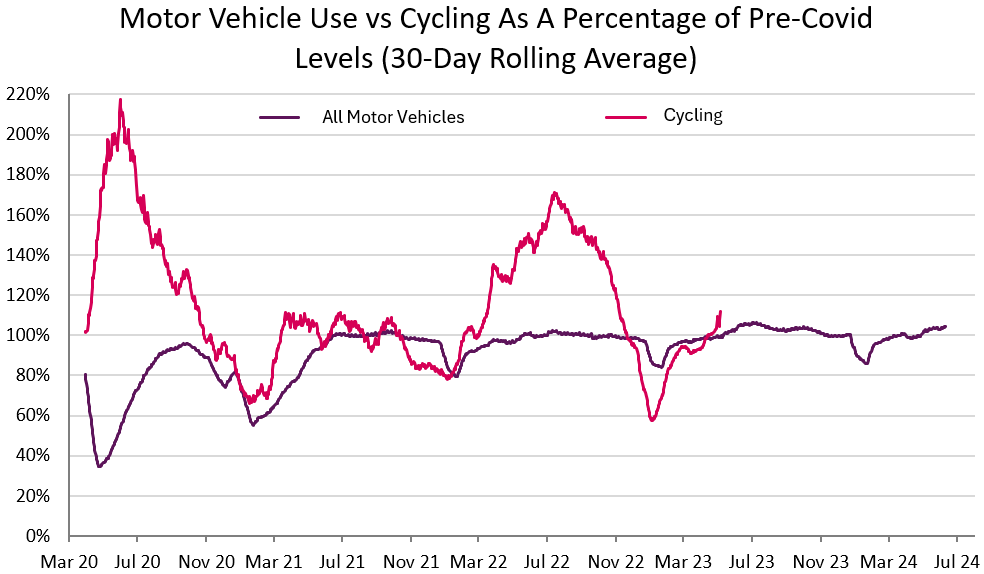

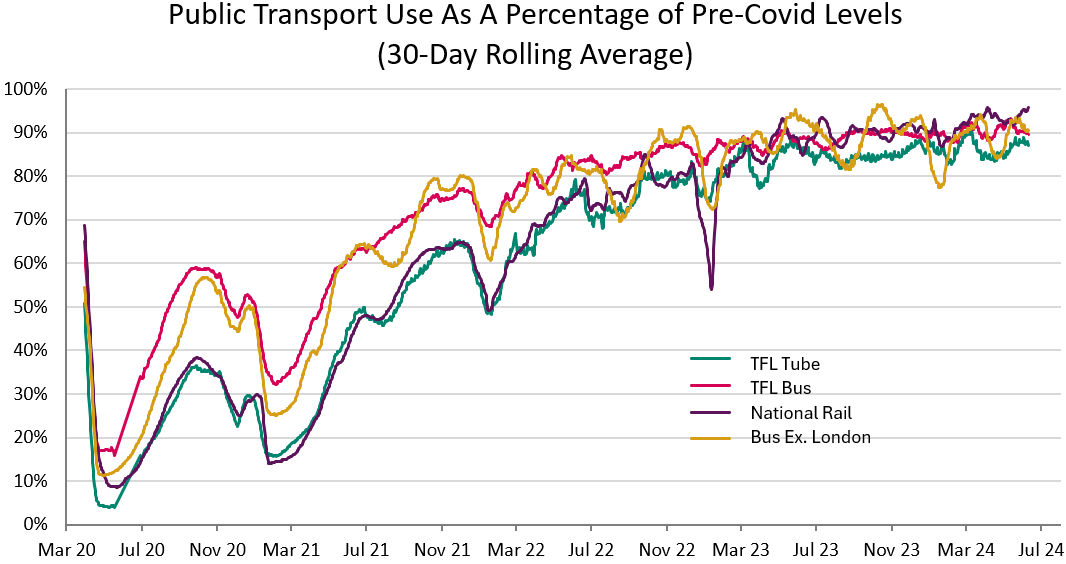

Regular readers will recall that we looked at the transport statistics throughout Covid to see the pattern on the roads and on public transport. The broad trend was a drop in car usage, a significant rise in cycling but heavier traffic (such as HGVs) being less affected. Have those trends stuck or has the position changed in the years since the pandemic?

The statistics show that car usage remains below 2019 levels by a few percentage points, van use is above pre-pandemic levels and HGV about the same. In terms of two wheels rather than four, motorcycle and scooter (not e-scooter!) use has risen to above 2019 levels after a period of decline up to that year.

Cycling has gone the other way, but then it could only go one way from pandemic levels when it increased over 45%. Cycling usage has now returned to the same level as 2019.

One area that has never recovered to pre-Covid levels is public transport. Despite the UK population increasing from 67.08 million to 69.85 million between March 2020 and now, less people than before are using the train or bus. Those who work in offices will know the main driver – working from home.

Car purchases – are friends Electric?

Although some of the main parties appear to be backtracking on net zero commitments, green pledges do feature in all of the manifestos so far, save Reform perhaps who instead promote North Sea Oil licences and shale gas drilling permits along with nuclear. Most parties say they will speed up the deployment of EV charging points, for example.

Whether the public are fully on-board with EVs is a different matter. Autotrader has just published data up to April 2024. In the first four months of the year, 15.7% of new car sales were electric, little change from 2022 and 2023. 56% of consumers were of the view that EVs were too expensive, including second hand. There was also concern over lithium batteries and the danger they present after a few high profile fires in car parks and on freight shipping. 47% of the public think there aren't enough charge points, a figure which the parties will be hoping to change.

RAC data shows the full picture with public charging points – they certainly are growing in number but whether this is quick enough and the right type of rapid charger is a different matter. In January 2022 there were 23,219 slow chargers and around 5,200 rapid devices. Fast forward to June 2023 and there are 35,559 non-rapid and 8,461 rapid, percentage increases of 53% and 62% respectively. It is probably comforting that the greater increase is in the fast charging bracket.

Of course, during this period EV ownership has also increased so the key figure may not be the number of charges but rather the number of cars per charging device. Figures are only available to Q3 in 2022 and had been rising since Q1 2020. In Q1 2020 there were 37 cars per public charger, in Q3 2022 this stood at 94. Definitely work to be done here!

New vehicle registrations for May 2024 when compared to May 2023 do show cause for optimism. Petrol registrations fell 2.1% while BEV vehicles were up 6.2%, Plug-in Hybrid up 31.5% and Hybrid up 9.6%. If this is maintained over the whole year, it will be good news for the EV market. This data is from the Society of Motor Manufacturers and Traders (SMMT).

Civil Justice Statistics

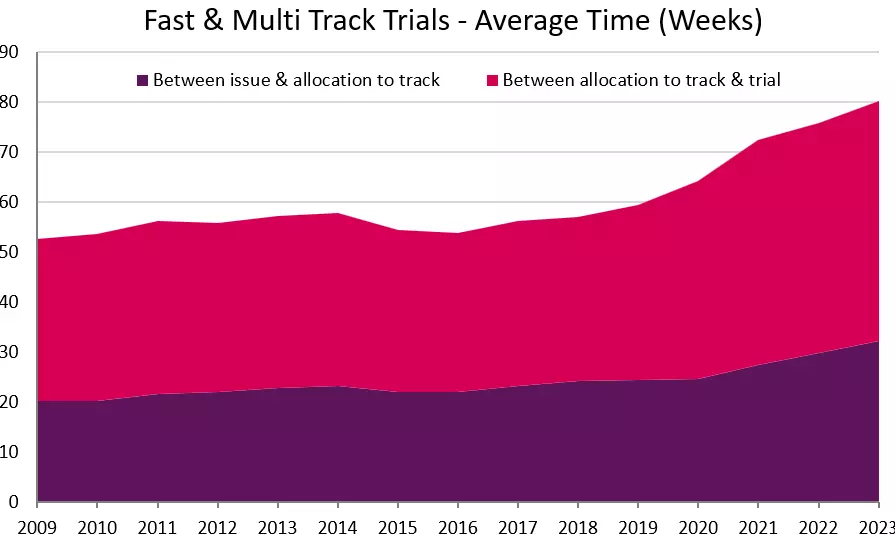

Practitioners in the civil arena know that court delay has been a constant theme since the pandemic, despite falling claim numbers and (partial) digital transformation. In 2019 at the time of the last election it was taking an average of 37.2 weeks to reach a small claims hearing from issue to trial and 59.4 weeks to reach a fast or multi-track trial. Those figures had risen to 54 weeks and 80 weeks respectively in the latest annual set of figures. During this time, the number of trials has actually fallen – 47,047 in 2019 for small claims falling to 40,623 in 2023, 17,707 falling to 12,841 for fast and multi track trials. This makes the rise in time to trial even more disappointing, especially when the reason given is often lack of judicial availability.

Firstly, the timeline for small claims track trials shows an increase from 2017 which has continued to date.

It can be seen that the rise started before the pandemic, from 2017 onwards.

For fast and multi-track actions, the position is as follows:

The reasons for the increased delay are most likely a lack of judges and court staff, plus many of the county courts were closed during the 2010s. Courts often have back-to-back listed hearings in the hope that most of them settle but the amount of late adjournments mean this isn't working in practice. Whether the digitalisation of the court process through the DCP and OCMC will change this and move cases more quickly towards trial is a moot point but at present there are stressors between the online and offline court system with communication issues. Listing to trial in a DCP case appears far quicker than on paper, but are these hearings actually going ahead?

Mediation will make a difference with some cases settling but how many will engage once proceedings are issued and if someone wants their 'day in court', they will still want to have it.

Mediation is compulsory from May 2024 for some cases with a value under £10,000 with expected expansion but only 39 mediators have been employed by HMCTS – this is surely not enough but one would expect further mediators to be added at a later stage. None of the political parties talk of a funding rise for civil claims, which appear again to be at the back of the queue. Without more judges, digitisation and mediation will only go so far to solving the problems we have.

Elsewhere, the economic downturn is evidenced by the rise in judgments and also enforcement for non-payment, with enforcement applications up 16% - a lot of which will be down to businesses recovering small debts.

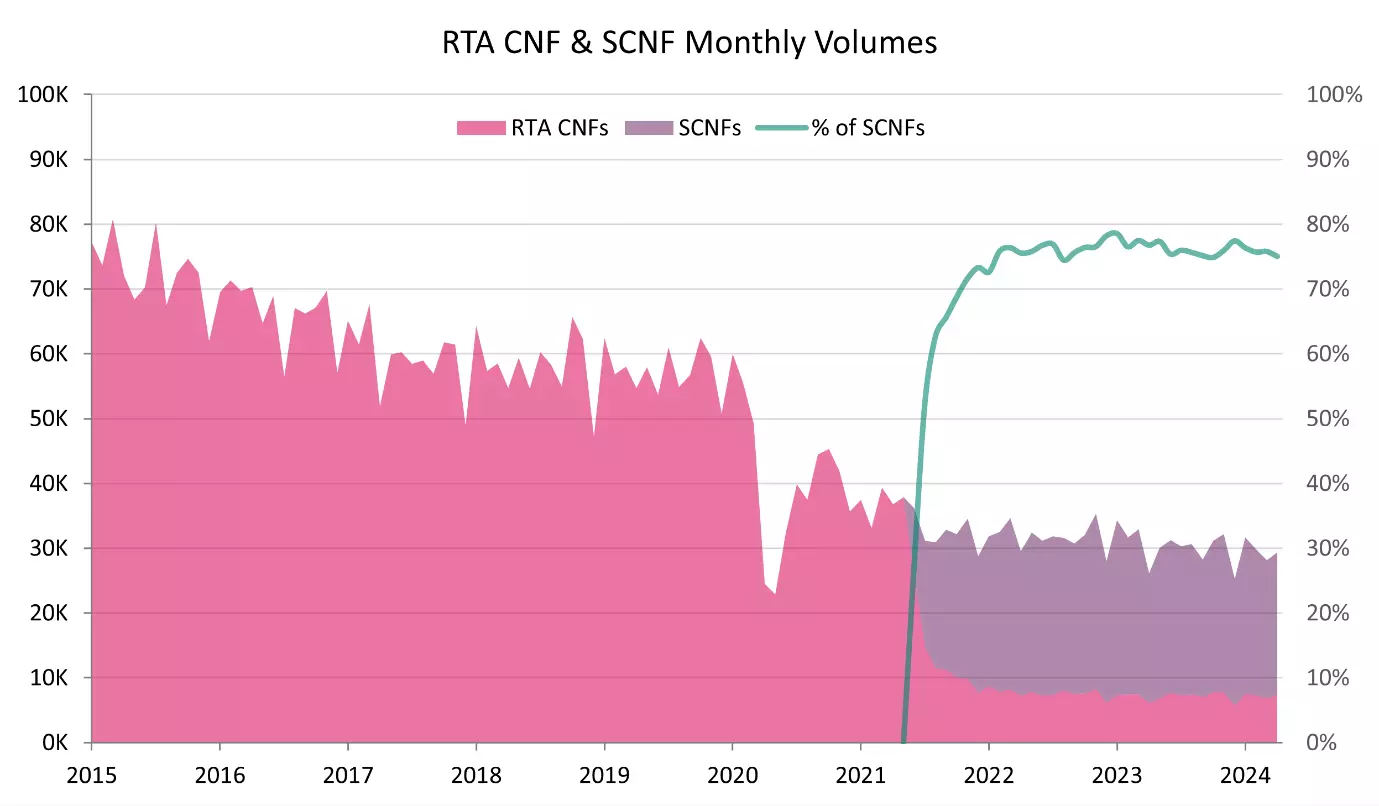

MOJ/OIC data – low value claims frequency

As we all know, the MOJ portal started life way back in 2010, even before the recoverability of CFA success fees was brought in during 2013. Looking at the month of December 2019, there were 50,791 CNFs submitted. In May 2024 only 6309 CNFs were submitted, showing the impact of the rule changes.

For the OIC, May 2024 saw 20,070 new RTA CNF's. Adding in the MOJ figure gives a combined total of 26,388 new RTA claims meaning submissions of new claims have nearly halved since the last election. It should also be noted that the number of unrepresented claims in the OIC still stands at only around 10%.

In terms of the near future, whilst claims levels are unlikely to find their way back to the levels of the last election, we expect a rise in MOJ claims and potentially a slight drop in OIC cases due to the latest JCG figures with an across-the-board increase of 22%. More claims could, until track limits are adjusted, exceed £5000 and end up in the MOJ. The tariff review and likely rise is not expected imminently and hopefully will not be up to the levels of the 22% JCG rise.

In terms of MOJ data, we also have data for EL, PL claims and Disease and it is useful to see the comparison. Whilst EL and PL cases have not dropped over the same period as much as Motor, in no way do additional claims make up for the loss of RTA claims coming through:

The EL Disease spike is due to new fixed costs rules coming in and the claimant fraternity bringing multiple Noise Induced Hearing Loss claims prior to the deadline.

In 2019, there was no OIC and no tariff so in terms of increased PI valuations let us compare a straightforward neck injury of two years duration. In 2019 this was worth up to £7,410. In the latest April 2024 edition, this had risen to £9,630, a percentage rise of 30%. 22% of that increase has come from the 16th to 17th editions only, demonstrating that inflation was certainly low in the preceding years.

CRU data

Of course, the MOJ and OIC figures only show the picture with low value claims worth under £25,000 (although plenty of high value cases do start in the portal) so the CRU data gives a fuller picture.

Whether driven by rule changes, habit changes, vehicle safety or a mix, claims in the motor arena have dropped considerably. The pre-OIC 2019-2020 registered claims figure was 653,052 which fell to 446,976 by 2020-2021 (partly due to the pandemic) then 387,687 in 2021-2022. The 2023-2024 figure, up to 31st March 2024, was down again to 348,806 registered claims.

Motor claims have dropped by nearly half in five years. This cannot simply be due to people having fewer accidents and must demonstrate behavioural and market changes caused by the introduction of the OIC process, the ban on pre-medical offers, a crackdown on cold-calling, and the lower tariff for whiplash. The development of fixed costs may reduce claims further.

Other areas have seen modest rises over the past few years, with EL claims rising from 43,769 to 44,547 from 2021-2022 to 2023-2024. PL claims have seen a more considerable rise, 52,724 to 58,933. Looking at the overall figure, 829,250 claims were reported to the CRU in 2019-2020. By the 2023-2024, this is down to 477,220.

It remains to be seen whether following the JCG rise and impending tariff review more solicitors (and claims farmers) have been attracted back to motor and if we will see a rise in the 2024-2025 figures but barring a complete U-turn it does not appear they will ever return to pre-pandemic (and pre-OIC) levels of claims.

What are the parties' manifesto commitments in relation to Insurance and Justice?

Conservative

Whilst crime and justice feature significantly in the Conservative manifesto, the focus is firmly on the criminal side with a pledge to deal with the backlog there by keeping Nightingale court rooms open, fund sitting days and invest in court maintenance. The only pledge on the civil side was to continue the digitalisation process and expand remote hearings capability.

Mention is made of leaving the ECHR if there was 'reason enough' and the conflict with UK laws. Also, although rather vaguely stated, the Conservatives would support our 'first class legal sector' with an Arbitration Bill. Again commitment is made to the Rwanda plan and curtailing illegal migration. Steps having already been put in place to limit legal migration, preventing foreign students' families settling here for example. The skilled worker threshold has been raised significantly which will have implications in all sorts of professions, including care and the NHS. There may be a shortage of carers which will increase their cost on a private basis which could impact claims inflation.

Green pledges are rolled back, with a 'more pragmatic' approach with no new green levies or charges cutting the cost of net zero. ULEZ would be reversed and local referendums would be applied to new 20mph zones or low traffic neighbourhoods. In the water sector they promise '100% monitoring' of water discharges and targets on leaks.

£36 billion is pledged for local roads, rail and buses including £8.3 billion to fill potholes. There is quite a significant series of pledges for rail, including a new line between Liverpool and Manchester and upgrading the Transpennine Route, also re-opening lines and stations shut in the Beeching plan.

Labour

The Labour manifesto is broadly silent on civil justice, concentrating on the criminal backlog and improving policing. Regulatory changes to speed up approval timings will be welcomed by business. There will be an increased role for Associate Prosecutors to address criminal court issues. Employment-wise, whilst not going as far as unions would like, there will be a ban on zero hours contracts, introducing basic employment rights from day one.

Potholes and tackling motor premiums have also been raised by Labour, with the party claiming pothole damage cost drivers almost £500 million, with the average worth £250. Regulators will be brought in to crack down on soaring costs. Potholes are one thing – they say they have funding from cutting the A27 bypass and will cut red tape – but cutting motor premiums are another. The detail of that hasn’t been forthcoming, but the suggestion it will come through regulation rather than tackling the drivers of claims inflation is concerning.

Elsewhere on Transport, Labour say they will provide better buses and trains, nationalising the latter, and deliver a new road safety strategy with a 'Plan for Drivers'. Whilst there has been much criticism of the ULEZ and low speed neighbourhood schemes and backtracking from the Conservatives, recent data shows a 20% drop in bent metal claims in the Welsh low speed districts, as reported by Esure. They appear to work and are preventing injury claims. They will also look to speed up the deployment of EVs charging points. with Shadow Secretary of State for business and industrial Strategy, Jonathan Reynolds stating "As the world pivots to generating electric vehicles, the UK automotive industry should be poised to jump at that opportunity."

Presumably there would be no reversal of recent whiplash reforms and a continuation of the digitisation of the civil courts and extension of ADR to try and bring the backlog down. Some commitment of spending on the county court estate, however, would have been welcome.

Liberal Democrats

Also going heavy on potholes, the Liberal Democrats have promised £300 million to try and fix the problem – an announcement immediately picked up on by the RAC who commented that this would re-surface 3% of roads and would only 'scratch the surface' of the UK's pothole problem.

In relation to Justice, the Lib Dems committed to reversing anti-protest legislation, scrapping the Illegal Migration Act and the Rwanda scheme. Safe and legal routes for genuine refugees would be provided. Whilst the manifesto notes the strain on the entire legal justice system, again the focus is on criminal, not civil. A devolved legal system is promised for Wales.

Green

As you might expect, the Green Party manifesto is very heavy on ecological and ESG issues, but it is wide ranging and specifically addresses justice. The Human Rights Act/ECHR would be upheld, Proportional Representation brought in as a new voting system and the House of Lords removed and replaced by an elected second chamber.

Whilst civil justice is again not addressed specifically, the language used in the manifesto seems to indicate funds would be made available: 'Repair and renew our crumbling court system with a £2.5bn investment'. Again as you might expect, green, publically funded transport is a key part of the manifesto, including bringing railways back into public ownership and £2.5bn for new cycle ways and footpaths. They would also bring in a frequent flyer levy and ban domestic flights that could be done in less than three hours by train. In terms of energy, on and offshore wind was prioritised along with cancelling recent fossil fuel licences.

SNP

The SNP manifesto is predictably calling for a further referendum in relation to independence. The fact that Scotland did not vote for Brexit is also clearly laid out in closer ties with the EU.

The priorities on civil justice are not the same in Scotland with less delay in the court system but there are some interesting justice proposals, including decriminalising drugs for personal use to prevent drug deaths and scrapping the House of Lords. On transport they pledge to invest in safer roads plus transfer full powers for complete integration of track and train to Scotland, including over Network Rail Scotland. In terms of employment, the SNP propose scrapping zero hours contracts and making sick pay available earlier and to the lowest paid. Paid maternity leave would also be extended to a year with 100% earnings.

Many of the other issues addressed show a convergence with Green and Lib Dem policies, certainly around energy and transport.

Reform

Reform have decided that the word manifesto is outdated so instead they launch what they term is their 'contract' with the public. The Justice pledges get a full page but there is no mention of civil. Criminal justice budgets would be increased, an additional 10,000 detention places provided, a re-definition of hate crime and mandatory life sentences for repeat violent offenders.

Elsewhere, ESG issues get short shrift with net-zero abandoned completely. Zero tolerance to drugs and removal of 'woke' policing are also targeted. Reform of the NHS is raised with tax relief on private healthcare. The income tax threshold would start at £20,000 to incentivise work over benefits. Harsh rules for benefit claims in including refusal of two job offers leading to withdrawal.

In terms of motor insurance-related issues Reform promise to 'stop the war on drivers' including the banning of ULEZ clean air zones and low traffic neighbourhoods. There would be no future ban on petrol and diesel cars and 'no legal requirements for manufacturers to sell electric cars'.

Finally, they pledge to abandon the ECHR and establish a British Bill of Rights and change to PR in the general election process.

Association of British Insurers

The ABI has put out its own manifesto at a very high level – focusing not on what say the motorist might want out of the election, but more the ESG side and savings and investments. They also suggest a regulatory and tax framework that is proportionate and fair. Pensions are also at the centre of the document, with a long-term strategy focusing on saver outcomes at the centre of policy decisions.

The green agenda is pushed significantly, with the claim that 'our sector can contribute one third (£0.9 trillion) of the £2.7 trillion private investment required to meet the UK's 2035 CO 2 reduction targets'. There is also a section on emerging risks to the UK and making it more resilient, with a special emphasis on cyber security. Cutting IPT is also suggested, perhaps unsurprisingly.

Comment on the manifesto promises and what this means for motor insurance

Only Labour have made a manifesto pledge to investigate and tackle the rising cost of motor insurance. Is motor, a compulsory insurance, just in an inflationary phase which makes it more expensive for the consumer? If the cost of repairs, write offs, technology such as EVs and AVs and supply chain inflation is causing this rise, what exactly could any government do to tackle this?

Whilst in the past insurers looked at the injury aspect of the cost of claims as the driver for increasing premiums, now PI plays a smaller role with far greater claims inflation coming from bent metal and cars that are increasingly more advanced. This inevitably leads to more expensive repairs and pressure on availability of specialist mechanics and engineers. What regulators can do about this is hard to see.

In the context of bringing premiums down, Sabre's Geoff Carter has previously stated "It would be useful, if a potential new government were able to work on what was driving premium increases by tackling the root cause". Carter added: “The industry would be more than happy to talk about what driving premium up, which is the cost labour, has cost of parts, technology in cars and the move to EVs". Aviva chief executive, Amanda Blanc has said that Labour’s plans to clamp down on motor insurance premiums are based on flawed logic and she felt that saying there was an issue with the market was "fundamentally flawed”.

Looking ahead – Civil Justice 24/25 – Impact of the election?

We are currently in Purdah – pre-election state in which very little can change. Whatever the outcome there will not be an immediate focus on civil justice and insurance claims. There was a rush to finalise some legislation but the snap calling of the election left little time.

The whiplash tariff review is complete and the report prepared but publication delayed. The contents should not alter but it is for the potentially new government to decide what to do with the recommendations.

There will be a new Lord Chancellor appointed should the government change. Following the recall of Parliament after the election, summer recess had been expected to commence on the 23rd July. Although it is understood that if Labour are elected, this may be pushed back with the summer recess shortened. The smart money would be on the tariff review being published and either implemented, changed or discarded, in the late summer or early Autumn.

The review of the Discount Rate will probably not be affected, as the panel is independent and already selected. The review must be commenced by the 15th July 2024, so time is tight but that is a commencement and not completion date.

The government confirmed in May that fixed costs in low value clinical negligence claims would go live six months later than expected, in October 2024. Most commentators now think that implementation will be delayed until at least April 2025 due to backlogs at the Department of Health. It is unlikely that implementation will be cancelled altogether but this does remain a possibility.

The Litigation Funding Bill fell by the wayside and did not make it through Parliament prior to it being prorogued. The Bill was designed to ensure that litigation funding agreements which provide for the funder to receive a share of damages are enforceable. It remains to be seen whether this will be brought back following the election although the Civil Justice Council has set up a working group to look at reform in this area.

One Bill that did make it through unscathed is the Automated Vehicles Act 2024. This puts in place the legislative framework for the next stage of development of self-driving cars. But the Act does not progress matters by itself. Public perception is vital if plans to automate are going to be successful. Does the public feel comfortable if and when complex levels of automation are reached which take driving outside their control? And what about infrastructure? There is much work to be carried out to make the country ready. We are still some way off here and perhaps commercial vehicles will be the starting point rather than private.

We should not be so far off legislation on e-scooters, however. Europe, including the Republic of Ireland, have legislation in place to allow e-scooters to be ridden on public roads with certain caveats over maximum speeds (20km) and age (16 minimum) plus outlawing riding on the pavement. PACTS completed their report and gave safety recommendations over two years ago – all the current government has done is extend the trial period for hire e-scooters again and again – now to 2026. Hopefully, if the government does change, PACTS recommendations can be accepted and regulation brought in. It will bring some certainty to insurers grappling with illegality issues.

What comes next – further expansion of fixed costs? Lobbying to increase the track limits?

The JCG increase was significant and will impact insurers' cost base likely pushing more claims into the MOJ process and becoming cost bearing as a result. The only way to bring this back to equilibrium is to increase the small claims limit by a similar percentage. It would be too much to hope that in future JCG increases could be matched with track increases of the same level so lobbying will need to continue.

Could fixed costs be increased still further? The original idea from Lord Jackson was to have an Intermediate Track all the way up to £250,000 with costs fixed. It is unlikely a future government would look to increase the fixed costs scope, and with the impact only just starting to hit on the current changes perhaps it is too early.

What might a Labour government mean for future civil justice reform?

There has been a lot of change in the market since a Labour market was last in power, in 2010. In 2010 there were still CFAs and unfettered costs rules. Whilst the MOJ portal idea was coming to fruition, the changes in the costs space may well have not happened under a Labour government. Can we see them reversing all this change? This seems highly unlikely, even with Trade Union pressure. The influence of the Unions seems less under Starmer, as can be seen with the slightly watered down employees' rights in the manifesto.

The commitment to reducing premiums is admirable but apart from stating that they will ask the FCA to formally investigate the market and cost of motor insurance, no detail has been given. They have said they will look at postcode pricing and fairness but premiums have been set by underwriters for years based on the risk of where the car will be most of the time and it is hard to see an alternative.

Additional Injuries – expansion of tariff?

In the last week, Aviva have commented on the rise in additional injuries presented since the whiplash tariff came in which they estimate at 65%, to include bruised knees, elbows, tinnitus and psychological upset. As we have continuously stressed – these injuries should not be caused by a minor road collision with minimal occupant displacement.

The ABI suggest that other injuries are brought in to the tariff so it extends from whiplash to say a soft tissue to the elbow or knee. The problem here is how far can it go? Certainly a tariff is not appropriate for all claims. Again, on the presumption of a Labour government, they may be unwilling to extend further.

What might be the main issues for insurers over the course of the next government?

This list is not exhaustive but perhaps useful to show that motor claims may not be top of the pile and will need continued lobbying to effect meaningful change:

- Climate change litigation – group actions

- AI – both opportunities and risk in this space

- Europe – will we see closer integration with the EU, over cross-border matters?

- Automated Vehicles: might we see genuine automation on the roads in the next 5 years?

- Claims inflation, how can premiums and indemnity spend be brought under control?

- Fraud, what will be the new areas of focus for fraudsters?

- Will claims farmers return in greater numbers with the JCG/tariff increases?

For further information please contact William Balfry.