This is a must-listen for anyone who instinctively thinks that increases in the cost of care are outstripping inflation and is concerned about what the future may hold.

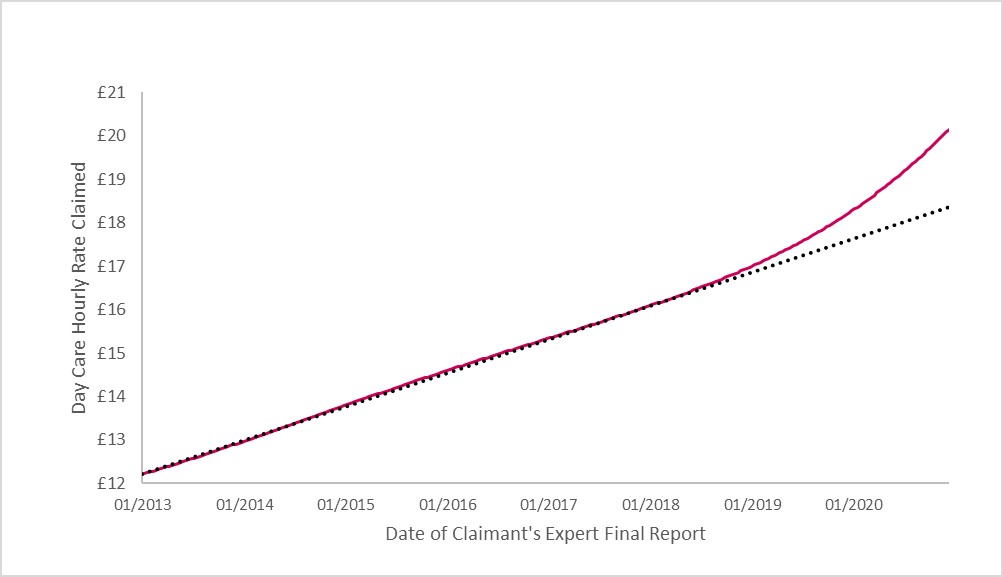

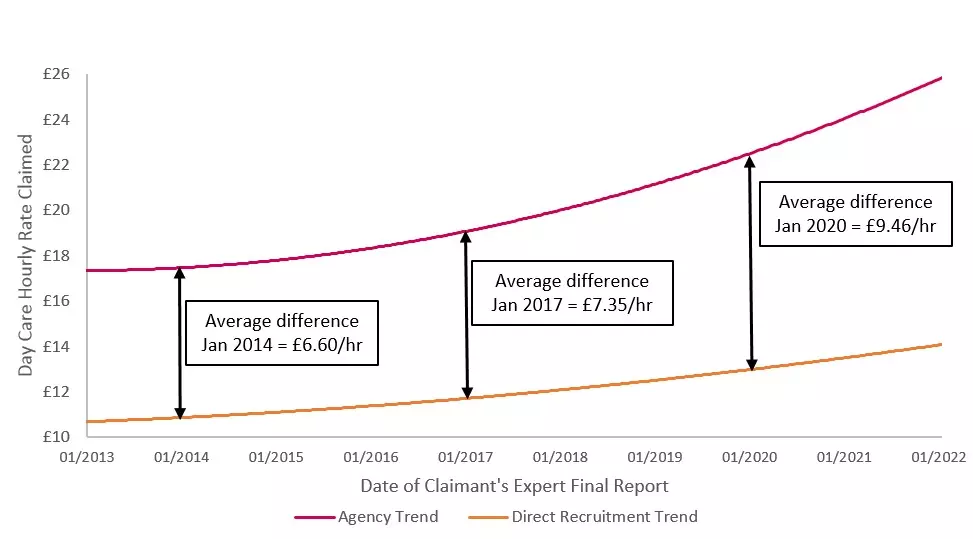

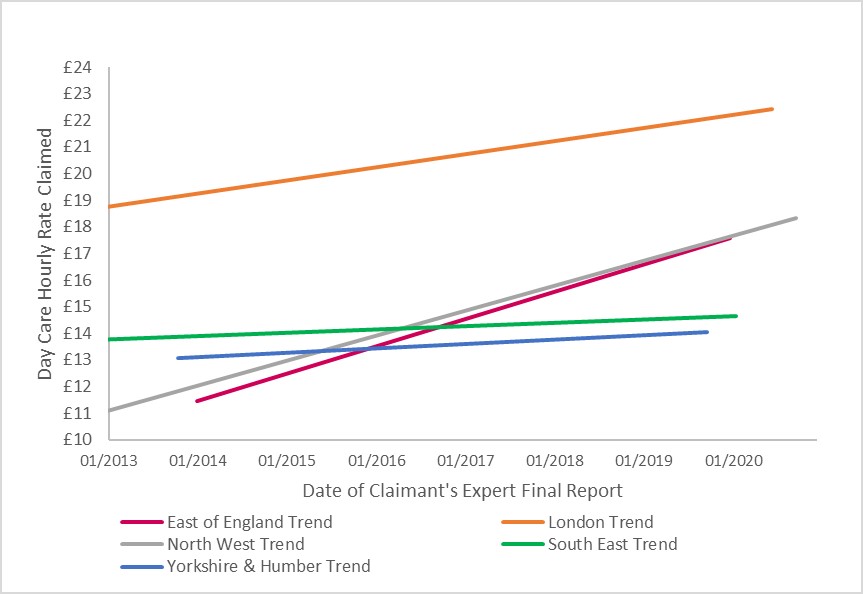

Traditionally the costs of care for claimants seriously injured in insured accidents have seen ASHE-related increases of around 3% per annum but the fear is that with the looming crisis in social care and COVID-19, the increases will now rise at a significantly greater rate meaning insurers will need to amend their reserve strategies for the cost of care. Simon White, Principal consultant in Data Analytics and Partner Ian Slater, discuss all this and more in the latest escalating cost of future care podcast.