Federal Decree Law No. 10 of 2025, issued on 30 September 2025 is a landmark statement by the UAE to align its anti-financial crime legislation with global standards endorsed by the Financial Action Task Force ("FATF").

A New Chapter in AML/CTF Legislation

The 2025 AML Law repeals and replaces the Federal Decree Law No. 20 of 2018 (“2018 AML Law”) introducing an expanded legislative framework for anti-money laundering ("AML"), counter-terrorist financing ("CTF"), and proliferation financing ("PF"). The law reflects the UAE’s commitment to meet FATF’s core framework of Standards, Outcomes and Recommendations.

Expanded Scope and New Offences

A number of significant changes have been made in the Definitions in Article 1 of the 2025 AML Law, including:

- “Crime” incorporating ‘the financing of proliferation’;

- “Predicate Crime”: expanded to include the financial crimes of, “the financing of arms proliferation, and direct and indirect tax evasion”;

- “Money Laundering” expanded to include, “their commission through digital systems, virtual assets, or encryption technologies.”; and

- New definitions of “criminal property”, “terrorist act”, “terrorist organisation”, “weapons of mass destruction”, “virtual assets” and virtual asset/service providers.”

Threshold for “Money Laundering”

In a significant shift compared to the 2018 Federal Decree, Article 2 of the 2025 AML Law, lowers the threshold for committing a money laundering offence.

Article 2 states that:

“anyone who knows, or has sufficient evidence or circumstantial evidence to support his knowledge, that all or some of the funds are derived from a predicate crime and intentionally commits one of the following acts shall be deemed to have committed the crime of money laundering.”

This means that public prosecutors are no longer required to prove actual knowledge of criminal intent; instead, knowledge may be “deemed” from objective circumstances. This change brings the UAE in line with jurisdictions such as the UK and is expected to facilitate more effective enforcement of AML provisions.

The new law criminalises arms and proliferation financing, making it illegal to finance weapons of mass destruction or related dual-use goods.

Terrorist Financing

Article 3 of the 2025 AML Law has aligned terrorist financing offenses in the UAE with the United Nations Security Council’s (UNSC) and FATF’s expectations, while also expanding the scope to address risks and emerging threats in the digital economy, including virtual assets and encrypted transactions.

Disclosure of Cross-Border Currency & Valuables

A notable difference between the 2018 AML Law and 2025 AML Law is the treatment of the disclosure requirements for cross-border transportation of currency and valuables. Under the 2018 AML Law, the disclosure requirements were present in delegated legislation in the form of executive regulations, Cabinet Decision No. 10 of 2019, which requires individuals to declare currencies, bearer negotiable instruments, precious metals, or stones above a certain threshold when entering or leaving the UAE. The responsible authorities for the oversight of the disclosure requirement were the Federal Customs Authority and the Central Bank of the UAE.

In contrast, the 2025 AML Law incorporated the disclosure requirements into the main body of the Federal Decree itself (Article 10), making it a statutory obligation and updating the responsible authority to the Federal Authority for Identity and Citizenship, Customs and Ports Security, in coordination with the Central Bank. This change reflects a move towards greater transparency and regulatory clarity, ensuring that the requirement is directly enforceable under the primary legislation.

Financial Intelligence Unit’s Coverage

The FIU’s role has been expanded and clarified, especially in relation to digital financial systems. Its coverage now also includes virtual assets service providers. The FIU’s authority has been extended such that it is able to coordinate with international FIUs and digital platforms for intelligence sharing.

The FIU now takes a leading role in the UAE national risk assessment with a focus on:

- Emerging technologies;

- Cyber-enabled financial crimes; and

- Proliferation financing risks.

National Coordination and Cooperation

Establishing the “Supreme Committee for Supervising the National Strategy for Combating Money Laundering, the Financing of Terrorism and the Financing of Proliferation” to oversee and implement national AML/CTF/PF strategies, coordinate legislative reforms, and represent the UAE internationally is the natural next step by the UAE in demonstrating it is a global leader in the fight against financial crime and will serve as a benchmark for other leading financial centres.

International Cooperation and Asset Recovery

Chapter 9 of the 2025 AML Law establishes a framework for international cooperation and asset recovery in combating money laundering, terrorism financing, and arms proliferation. It mandates that the UAE cannot reject international cooperation requests solely on the basis of financial, tax, or confidentiality grounds (except for legal professional privilege), and allows for the execution of foreign court orders related to asset seizure or confiscation without requiring a local investigation.

The law prioritises the swift and confidential handling of such requests, encourages broad information exchange with foreign authorities, and provides for judicial assistance, extradition, and asset recovery.

Additionally, it requires the UAE Cabinet to regulate the procedures for managing and disposing of recovered assets, while ensuring the protection of rights for bona fide third parties and promoting inter-agency cooperation within the UAE to enhance asset recovery effectiveness.

Licensing Requirement for Financial Activities

Article 20 of the 2025 AML Law introduces a statutory requirement for licensing, registration, or authorisation from the competent authority or regulatory authority in respect of any financial activities undertaken by DNFBPs, and virtual asset service providers. Failure to do so could result in wide ranging sanctions including, imprisonment under Article 32 of the law.

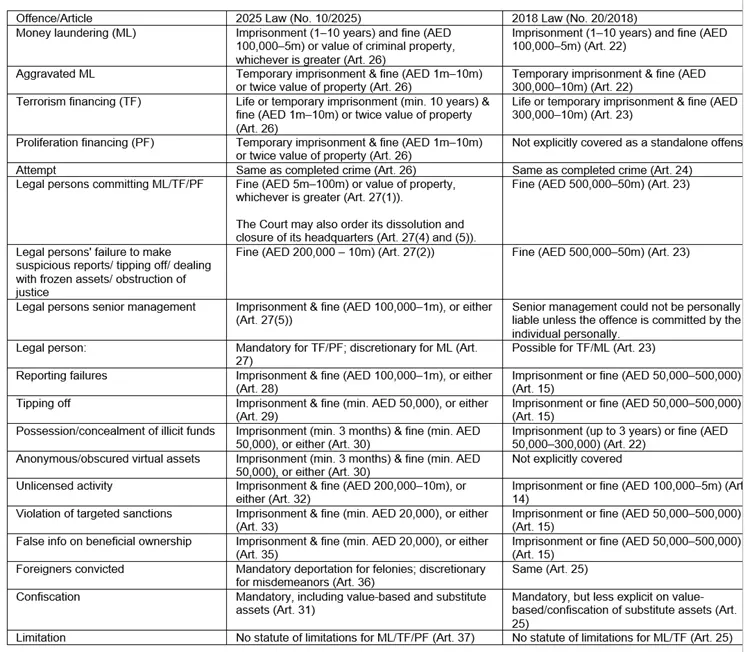

Comparison of Punishments under 2025 AML Law vs. 2018 Federal Decree

Sanctions under the 2025 AML Law have been significantly increased, see the comparison below.

“Tipping Off” Offence

Article 29 of 2025 AML Law links a “tipping off” offence covers both intentional and grossly negligent acts, applies to a broader range of disclosures and failures, including mismanagement of funds subject to precautionary measures and it introduces aggravated penalties if the offence results in loss or destruction of criminal proceeds.

In contrast, the 2018 AML Law tipping off offence is limited to disclosure of information about STRs or investigations to the customer or any other person and does not explicitly cover gross negligence or failure to manage funds, nor does it specify aggravated penalties if the tipping off results in loss or destruction of proceeds.

What This Means for You

The new AML Law significantly increases the responsibilities of companies, their boards, and senior management by imposing stricter requirements for transparency, reporting, and cooperation with regulatory authorities and law enforcement.

Organisations must now implement robust compliance frameworks, programmes and measures to effectively detect, mitigate, and prevent financial crime and its underlying causes in the UAE. The law broadens the scope of corporate liability, making companies accountable for a wider range of offences and holding senior managers personally liable for failures in oversight.

It also introduces tougher penalties for violations, expands due diligence and beneficial ownership obligations, and heightens the risk of prosecution for failing to report suspicious activities or for tipping off others about investigations.

In practice, this means companies must review and strengthen their financial crime compliance frameworks, ensure strong internal controls, and remain vigilant to avoid severe legal and financial penalties.

Thank you to Bhavesh Dattani and Kholoud Sweidan for the production of this article.

If you or your team would like support navigating these changes, please contact Bhavesh Dattani or Kholoud Sweidan at DWF (Middle East) LLP.