Department for Transport data shows a significant decline in road travel for November as expected, and the October portal data shows a steady rise before the impact of a full lockdown, albeit large parts of the country were experiencing Tier 3 restrictions in October. The anticipation of a deal/no deal announcement over Brexit remains, notwithstanding previous assertions that a deal had to be agreed in principle by October 15 to enable the legislation to be approved by all parties before 31 December. We should hear further any day now, although I've a feeling we've said that before… Similarly with the whiplash reforms, whilst there is a lot of talk and further announcements, substantive developments have to be searched for carefully. We cover the main talking points below.

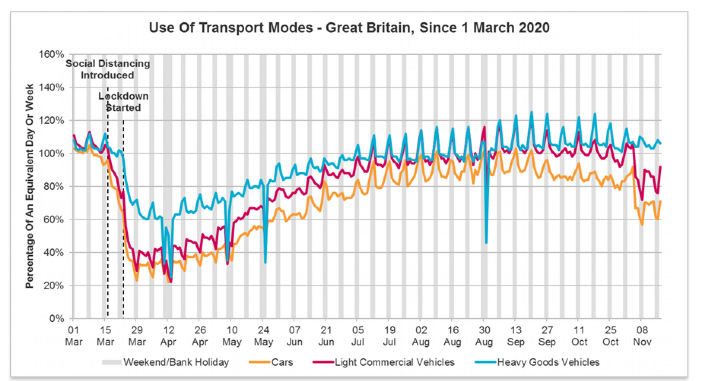

Transport Usage

The return to a national lockdown has seen private car usage take a plunge to the lowest level since late May, hovering between 60-70% of pre-COVID levels. Light commercial vehicle usage also dropped considerably.

Of course, during the first lockdown car usage was down to 20% and a further drop was anticipated. It is interesting to see that HGV usage has not actually declined at all this time, reflecting more resilience perhaps in supply chains since March.

Travelling to work v working from home

The ONS social and economic indicators updated on 19 November showed that across all UK industries, of businesses not permanently stopped trading:

- 9% of the workforce were on partial or full furlough leave

- 28% of the workforce were working remotely instead of at their normal place of work

- 60% of the workforce were working at their normal place of work

The arts, entertainment and recreation industry and accommodation and food service activities industry had the highest proportions of their workforce on partial or full furlough leave under the terms of the UK government’s Coronavirus Job Retention Scheme (CJRS), at 34% and 22% respectively.

The information and communication industry and professional, scientific and technical activities industry had the highest proportions of their workforce working remotely instead of at their normal place of work, at 77% and 65% respectively.

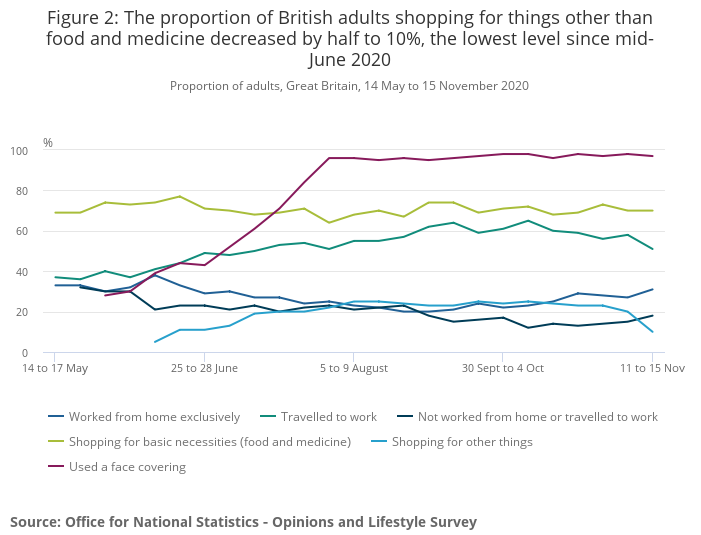

The graph below shows the effect of the November lockdown in a number of areas – a reduction in people travelling to work and a reduction in people shopping for items other than basic necessities:

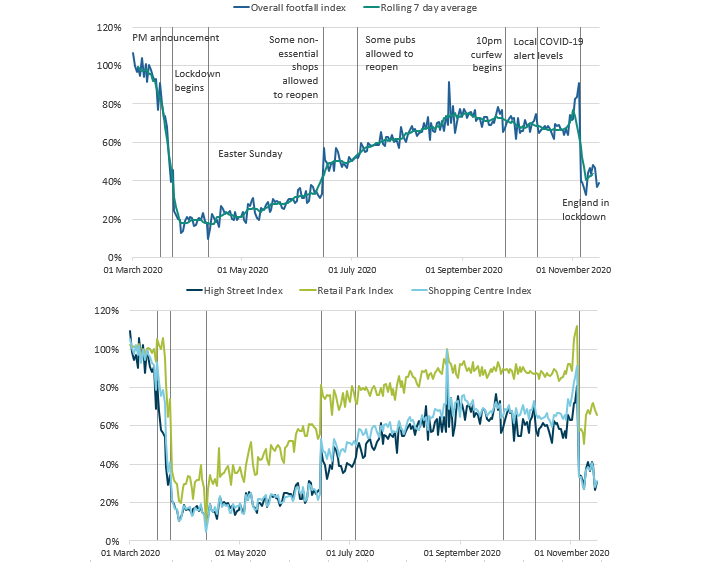

Footfall

Again, taken from the ONS data we can see that in the latest week, overall seven-day average footfall decreased to 44% of the level seen the same day last year, compared with 58% the previous week. This remains above the spring lockdown low point seen in the week ending 12 April 2020. Footfall across all retail locations in the UK fell in the latest week compared with the previous week, with footfall on high streets and shopping centres following a similar pattern, both at 36% of levels seen the same time last year, whilst footfall at retail parks was relatively high, at 68%. The large decrease in footfall coincides with the national restrictions in England, which took effect on 5 November 2020.

Whiplash reforms

An outsider reading the recent proclamations from the MOJ and the MIB about the state of the whiplash reforms would be left in little doubt that implementation will take place in April 2021:

The Civil Procedure Rule Committee met on 9 October to review the work of the sub-committee drafting the Rules, and the public minutes noted that work was continuing. The sub-committee indicated they needed to see the finalised screens from the Portal build before recommending approval, to which the MOJ confirmed the build would be complete before the 4 December CPRC meeting. Minutes from the November meeting have not been published yet.

Then on 28 October in response to a written question from Andy Slaughter, Chris Philp stated that "…the Government remains committed to implementing the Whiplash Reform Programme by April 2021. The Portal will be accompanied by comprehensive and clear guidance for the public and if at any stage users need assistance, they can call a dedicated Portal Support Centre".

The MIB released an update on 19 November confirming the Portal was nearing completion and that the MIB and the MOJ are currently working together on details of the pre-launch and launch timetable. This includes communications plans for updating stakeholders in the run-up to April 2021.

Finally the MOJ also confirmed through David Parkin at a Legal Futures conference on 23 November that ministers are still determined to implement the whiplash reforms in April 2021. The consultation between the Lord Chancellor and the Lord Chief Justice had commenced, and the intention was to lay the draft whiplash injury regulations early in the new year, along with the new Rules.

However, if you scratch beneath the surface all does not seem quite so straightforward. The CPRC have only one more meeting planned this year on 4 December and it seems highly unlikely they will be in a position to sign off the Rules in their entirety at that meeting. The MOJ had also previously committed to a 3 month "notice period" for the industry between publication of the Rules and the implementation date. It would seem highly likely that either the notice period or the April date will have to give.

Either way, it seems clear the Rules will only be published when they are final, and any flaws in the drafting of the Rules will fall to be dealt with by the Courts. The same approach is being taken to the major gap in the reforms around the lack of a tariff for non-whiplash injuries, with the MOJ indicating at the conference that they will support an expedited trip to the Court of Appeal to provide some clarity on the approach that the MOJ themselves have been unable to deliver.

The MOJ do however seem confident that the consultation with the Lord Chief Justice is little more than a tick box exercise, dismissing the recent lobbying from MASS to the LCJ. The expectation of the MOJ is the tariff will be little different to that previously published save for a likely increase for inflation. Certainly any significant change would drive a nail into the original anticipated savings in premiums.

One thing is for sure, whether the reforms are implemented in April or July 2021, we can look forward to a period of challenge and circumvention as the market adapts to the new regime.

Other news and consultations

In other developments, the Civil Justice Council has launched a review of the full range of Pre-Action Protocols. They have indicated that they want to hear from anyone with experience of, or an interest in, the protocols including the judiciary, practitioners and litigants. This will be of particular interest to insurers as the protocols govern or certainly influence the behaviour of claimants which directly affect claims processes, for example around claims incubation and encouraging disclosure of medical reports. The CJC has made a survey available to those wishing to participate in the review, which will be open until 18 December, and can be found here. DWF will be providing a full response to the review in due course.

The Government announced last week that it will bring forward a ban on diesel and petrol car sales by 2030, rather than 2040, highlighting their green agenda. Retailer Halfords stated that sales of e-scooters had risen 184% in the first six months of their financial year, despite the fact that it is still technically illegal to operate privately owned e-scooters on UK roads. London trials of e-scooters are due to commence shortly which may increase insurers' exposure to claims resulting from accidents.

The government has also published its response to the consultation on micromobility vehicles, flexible bus services and Mobility-as-a-Service (MaaS) as part of the Future of Transport regulatory review. It noted the widespread support for legalisation of micromobility vehicles, with the accompanying need for regulation. There was a strong view that central Government should play a leadership role in development of MaaS platforms, with local authority leadership for trialling in local areas. Key themes raised included the need for standardisation of data, and reviewing the framework for consumer protection.

There is also a new Department for Transport consultation seeking views on the context of the "Future of Transport: rural strategy"; an assessment of the mobility trends in rural areas, and the emerging opportunities for rural environments in transport innovation; and how to help shape these opportunities to benefit rural areas. The consultation closes on 16 February 2021. Read more in the DfT press release.

Courts

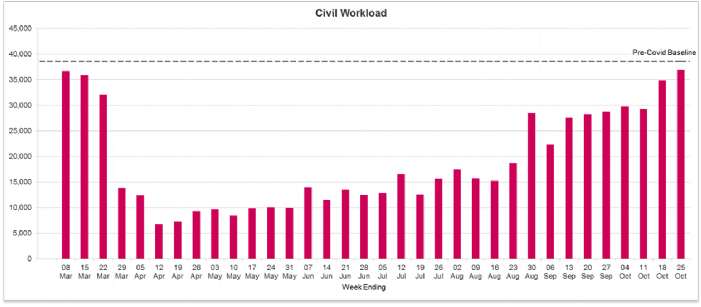

The civil workload in the form of new claims issued continues to rise, now at its highest level since the crisis began and back to pre-COVID levels:

It is also interesting to note that the Civil Courts were busier in September 2020 than at any time since March 2020 with 123,806 claims received and 25,625 defences actioned. The rise in activity seems to be in large part due to the lifting of standstill agreements in insurer to insurer recovery litigation.

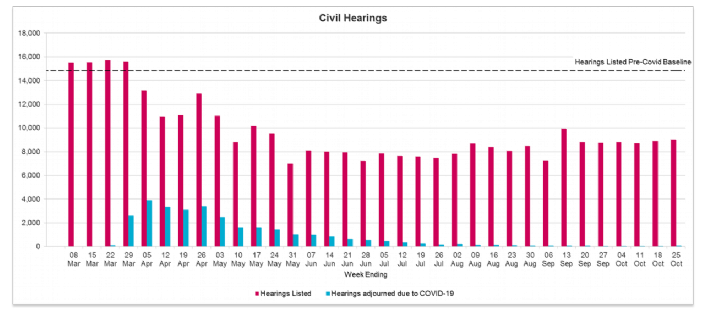

The rise in civil hearings has however levelled off and remains well below lockdown levels:

Of particular note out of the latest statistics which run to September 2020, the time taken for a small claim to reach trial has increased from around 38 weeks at September 2019 to 52 weeks in September of this year, a worrying trend when you consider the amount of extra small claims hearings the new claims process may lead to. A year from the point of litigation to trial seems a long time for a small claim, and doesn't bode well for the launch of the new small claims process next year.

Portal Data for October 2020

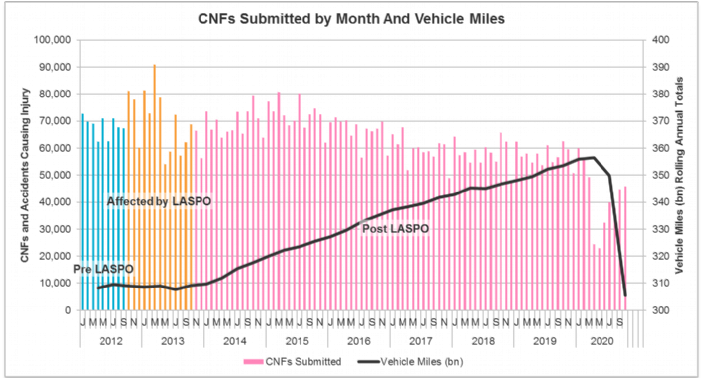

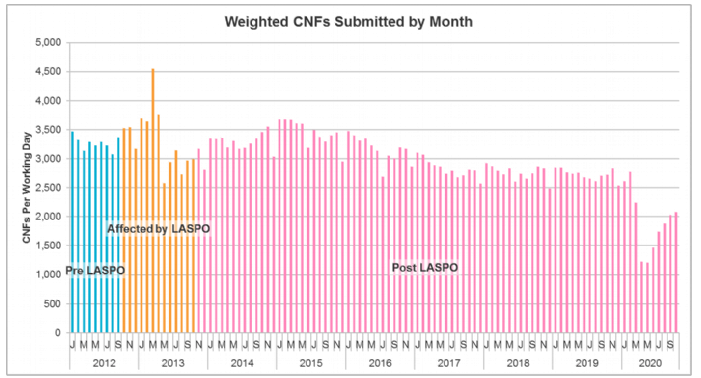

New RTA Claims

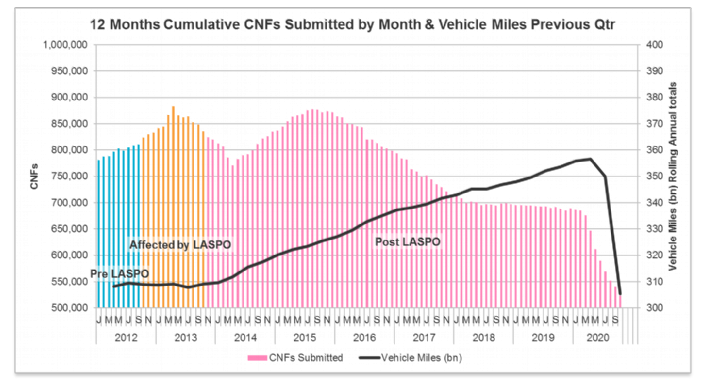

October claims showed a minimal rise in numbers to 45,723, 2.3% up on the previous month, probably reflecting the North's Tier 3 lockdown and commencement of the Wales 'firebreak' lockdown combining to slow the previous growth. Numbers were 26.9% down compared to the previous year.

The cumulative picture below is just starting to bottom out after 8 months of affected data, somewhere around 525,000 claims per annum on a rolling 12 month basis. Interestingly that still remains higher than the number of reported RTA claims to CRU back in 2000-2005, which just goes to show that even a global pandemic couldn’t put the whiplash genie back in the bottle. Will the whiplash reforms have any more success next year?

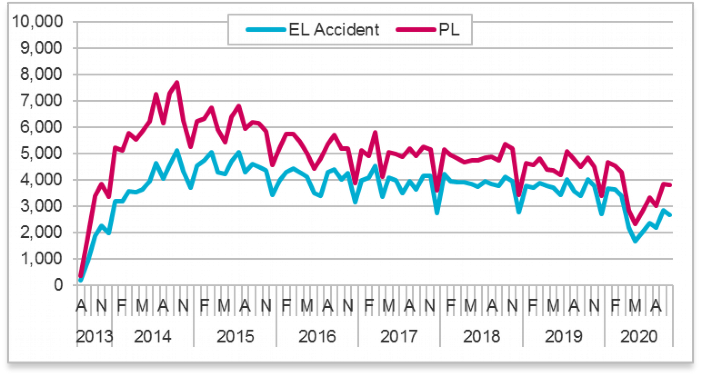

New Casualty Claims

New PL claims through the Portal remained fairly static at 3,817 new claims, a drop of 1.1%. New EL Accident claims actually saw a drop of 6.1% when compared to the prior month, down to 2,670 submissions. This is 33.6% down compared to October 2019

.

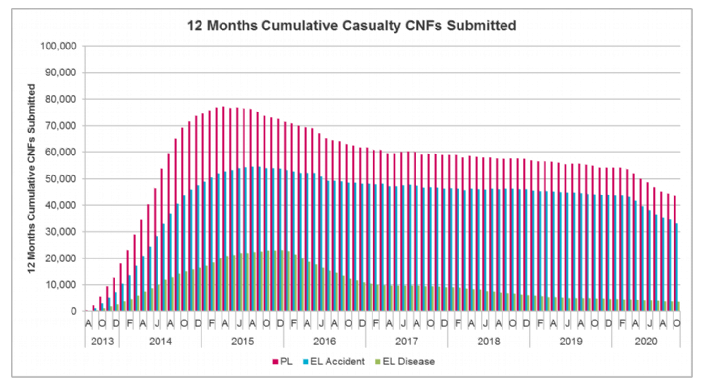

The cumulative picture shows a decline not dissimilar to that seen in RTA claims:

We predicted last month that the tighter restrictions during October in terms of Tier systems in the North and the closure of some hospitality venues would hamper EL/PL figures and so it is shown. With the nigh on complete lockdown in November, and referring back to the footfall statistics and the reduced number of people in the workplace detailed above, next month's figures could see a reduction similar to May/June.

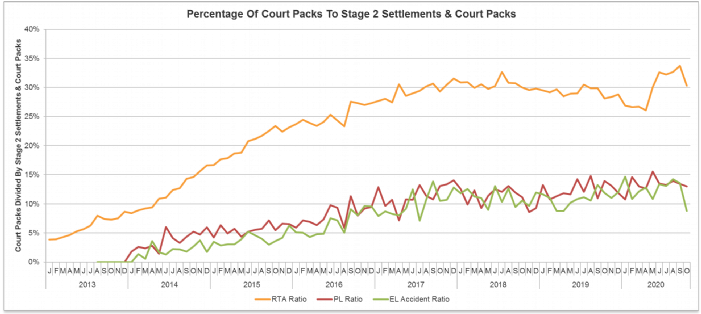

Court Packs and PSLA

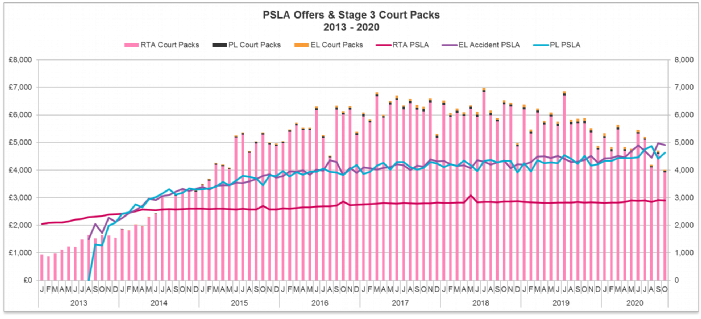

Interestingly, the number of Court Packs was down considerably across the board, demonstrating the reduced throughput of claims in the portal since March 2020 with less cases to push to settlement/hearing. The number of RTA Court Packs dipped below 4,000 for the first time since February 2015:

Average PSLA for RTA cases appears for the moment to have flattened out at around £2,900 (£2,902 for October), up approximately £100 over a 12 month period.

EL accident PSLA has dropped from the previous month's record high to £4,906 for October. There has been a more dramatic rise in EL Accident PSLA generally which is approximately 10% higher than 6 months ago.

PSLA for PL claims on the other hand is at £4,633 for the month, an increase of 5% on last month, and generally figures are around 5% higher for the last 6 months than the previous 6.

The reduction in CPPs is also reflected in the percentage of claims moving to that stage, reducing to around 30% from a previous high close to 35%:

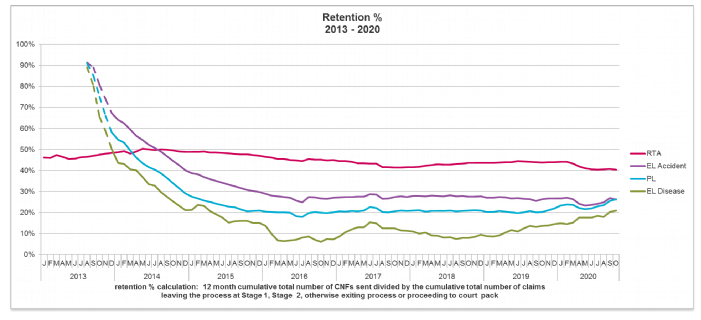

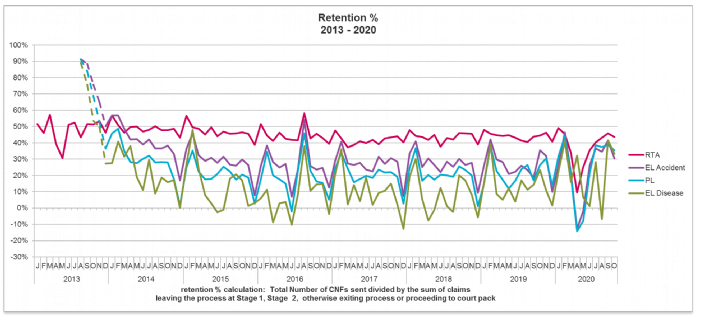

Retention rates

Meanwhile, after some yo-yoing during the lockdown months, retention rates in the portal remain broadly static, in percentage terms, with PL and EL accident back to pre-lockdown levels:

Comment

In terms of expectations for next month's Portal data, one would expect this to show a further drop off in activity levels as the second lockdown, albeit not quite as aggressive as the first one, comes into effect. We will certainly know more on the Brexit terms, and maybe we will also have more news on the whiplash portal – or at least be able to draw some further conclusions from the lack of news.

If you have any queries, please contact Nigel Teasdale.