The 'compliance advice for business' provides a range of examples of what the CMA considers to be misleading. The entire document is worth considering to see if your team's favourite practice is included, but we have pulled out a few key points below.

False sense of urgency

Many of the examples in this segment are common sense and are not new principles, for example the promotion does not end when it claimed it would. But it makes clear that where a deal ends and the new deal offers the substantially the same deal this is likely to be misleading. The example it gives is a scenario where the there was 50% off product X and that offer ends, then product X is included in an offer for 50% off all items, including offer X. Clearly the second offer is a different deal, but even though it is 'literally true' the CMA considers it misleading as there is a 'comparable' follow through offer.

We get asked a lot about extending offers and how this is done – plus how this advice will impact if and how this can be done in the future.

Interestingly it also includes false checkout timers in the same category of misleading behaviour, as they place undue pressure on consumers. Having a countdown is fine, and is usually to avoid stock being held for long periods in baskets and not being available to others customers, but it must be genuine and actually end.

In a similar vein, messages like 'hurry 10 people are viewing this item now' or similar and 'low stock' messages are also likely to be considered misleading, even if stock levels are low as they will be replenished quickly. Or in the context of the people viewing or buying, messages that there is more than enough stock to cover demand or statements that 20 people are looking at the product 'now' but 'now' is considered to be in the last hour, will be considered misleading. These are fundamental shifts in interpretation of the rules which will impact on website operations and will need careful consideration going forward.

Promotional prices

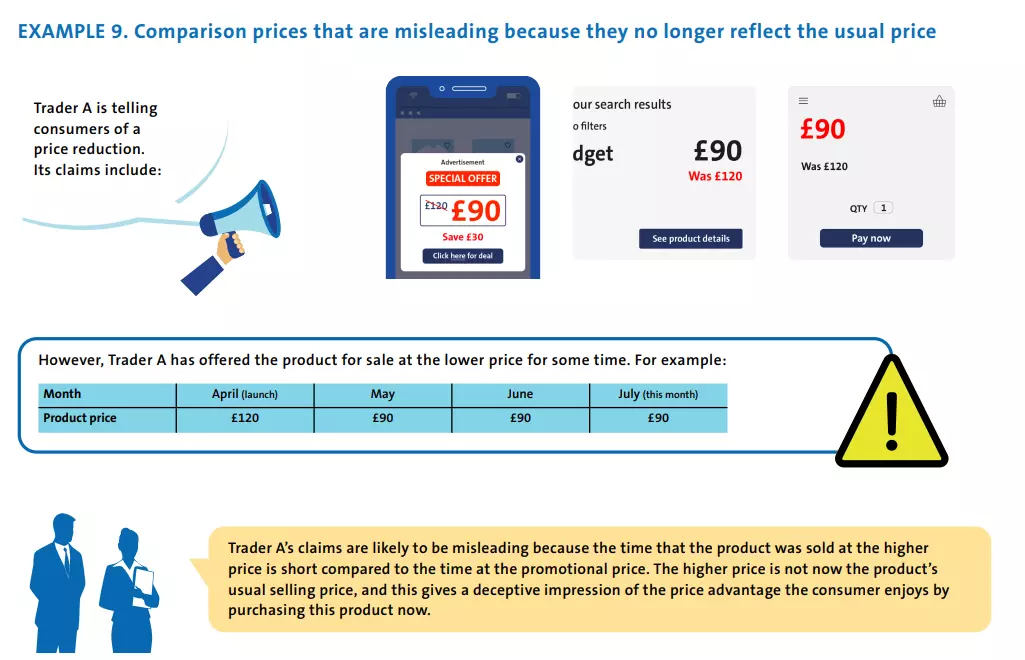

While many of the concepts are ones that are familiar, the way in which the CMA has described them creates confusion. For instance, consider example 9 below:

Source: CMA

The issue here is not the 'usual selling price' – it is actually a combination of two factors. One, that the trader has not compared against the immediately previous selling price, and two, it cannot have been sold at the higher price for longer than it was at the lower price – both of which are inconsistent with the CTSI Guidance and would have been considered unlawful for some time.

We are concerned by the reappearance of the term 'usual price'. While the advice links to the CTSI Guidance for Trades on Pricing Practices the phrase 'usual price' appears a grand total of zero times. This is a concept that the ASA has invented in its reviews of pricing claims, and is arguably more misleading than the practices that it seeks to regulate as a 'usual' selling price suggests an assessment of value over a prolonged period that many consumers simply do not do, and importantly it is not reflected in any previous legal requirements.

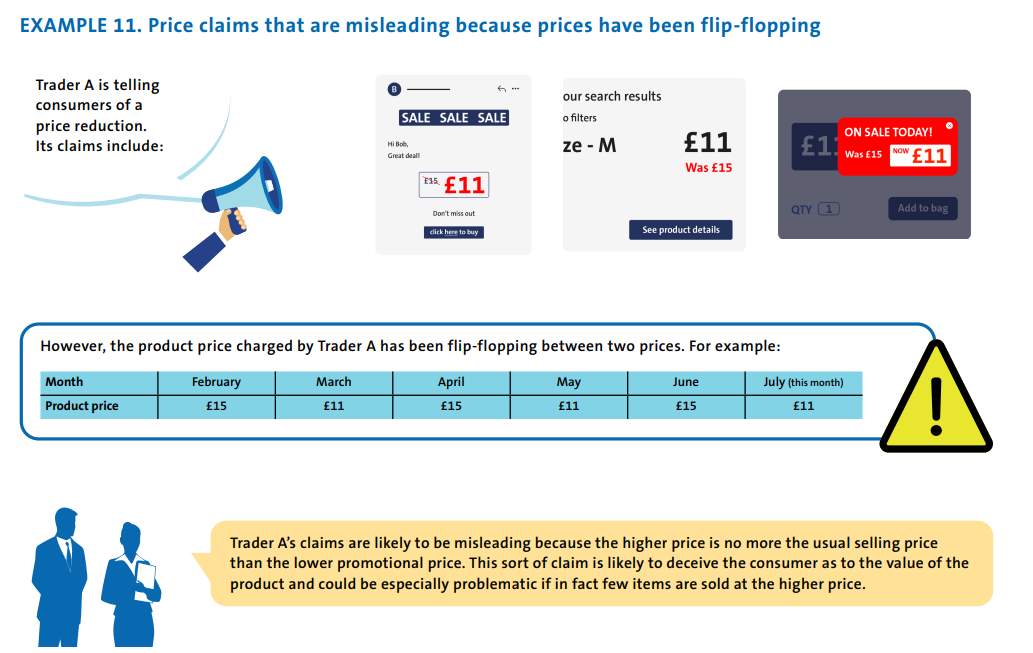

This raises its head again in example 11 (below), which deals with what it calls 'flip-flopping' pricing and what we refer to as a price history that looks like a castle's battlements. The CMA say that this is misleading as the lower price is the price that the product is sold for as long as it is at the higher price.

Source: CMA

Here the position is much more nuanced as assuming the lower price is held for no longer than the higher price, then it is legally compliant and does genuinely offer a saving on the price last month, and while perhaps is not desirable, would be fully compliant with the CTSI Guidance and the law. Though we are aware that the ASA has routinely found this to be misleading, however only after considering information that no consumer typically would and looking at a year's worth of pricing data.

It is clear that the goalposts and risk associated with price promotions and time limited offers online have adjusted – businesses need to carefully consider these topics before launching future campaigns.

Please get in touch with our contacts below to discuss how to mitigate your risk in this area.