New Year, New Ogden: The new Discount Rate in practice

On 2 December 2024 the Lord Chancellor announced that the Personal Injury Discount Rate (‘PIDR’) for England and Wales would change to 0.5% from 11 January 2025, bringing England and Wales into line with the 0.5% rate set in Scotland and Northern Ireland in September 2024. For the first time in 7 years, we now have the same rate in England, Wales, Scotland and Northern Ireland. However, there is no certainty that this will be the case on future reviews as the Government Actuarial Department (“GAD”) has adopted a substantially different methodology to setting the rate in England and Wales to that used in Scotland and Northern Ireland.

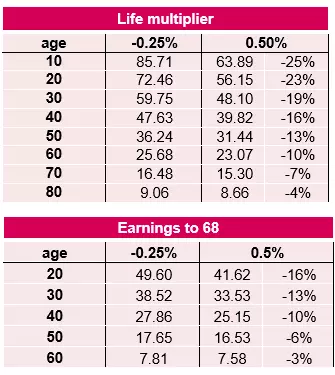

The move from a negative rate of -0.25% to a positive rate of 0.5% means that multipliers for future life losses reduce by almost 20% for claimants over 30 and 10% for those over 60.

The current, 8th, edition of the Ogden Tables already contains multipliers at 0.5% so the change in the rate does not mean that we need a new set of Tables. They would only require updating if the underlying ONS life expectancy data changes significantly from those projections.

There are some problems with the way the Tables are presented. The first being that to cater for different discount rates – a change which only occurs once every 5 years – the Tables present multipliers at a range of rates from -2% to +2.5% and a whole new table must be produced for each retirement and pension age. That produces 32 tables just to cater for 8 retirement ages. To add in an additional retirement age, say 67, we need another 4 tables (male earnings, female earnings, male pension, female pension), so catering for every possible retirement age would make the number of tables overwhelming. The reality is that now the discount rate is determined, we are not interested in the multipliers at any rate other than the prevailing one, 0.5%, so about 90% of the data in the tables is irrelevant, at least until the rate changes again.

This problem is solved by the Additional Table for the 0.5% discount rate published by GAD on 9 January 2025 which only provides multipliers at the 0.5% rate. This allows users to easily obtain a multiplier to any retirement age or any future age, from any future age or between any ages. This one table does away with the need for the other 34 tables and provides a much better solution to calculating multipliers.

There is still one drawback for the pre-prepared Tables which is that they only provide multipliers for "whole" ages and if the claimant is part way through a year the multiplier must be calculated by "interpolating". For example, if a claimant is 45.25 the multiplier is calculated by finding the multipliers at 45 and 46 then taking away 0.25 x the difference between those multipliers to the multiplier for 45. Whilst it may be tempting to round a claimant's age to the nearest birthday to achieve a whole age multiplier, this should really be avoided as any change to the multiplier applies to every single annual future loss and can easily result in giving away substantial damages.

Getting multipliers right is critical to the proper assessment of damages and can save significant sums on large claims. As mentioned in our recent Insight Seminar, our online Ogden multiplier calculator is in the final stages of development and will be made available to our clients soon.

Introducing our Areas of Core Excellence (“ACE”) Groups – Driving excellence in key areas

Under the direction of Partner Mike Renshaw, these groups will provide clients with specialist expertise and strategic advice tailored to specific claim types.

The ACE groups will focus on 12 key areas:

- Traumatic Brain Injury

- Spinal Cord Injury

- Amputation

- Chronic Pain

- Functional Neurological Disorders

- Local Authority and Public Sector

- Disease

- Abuse

- Fatal Claims

- International Claims

- Sports

- E-Scooter and Automated Vehicles

Every quarterly edition of the Insurance Brief will have a focus piece on one of our ACE groups, starting this month with our Amputation Group.

Quarterly Focus - Amputation Claims ACE Group

This group, led by Stuart Giddings and Tom Higson, has been created to provide clients and large and complex loss teams with direct access to specialist lawyers who have thorough knowledge and expertise in handling amputation claims. The group will undertake horizon scanning, prepare thought leadership articles, share experts and rehab specialists and oversee the introduction of (and access to) a bespoke prosthetic costs database which tracks increasing costs of devices and maintenance over time. The group will also be at the forefront of new prosthetic technology (including AI) and product development.

Our ACE group’s specialist knowledge in amputation claims, combined with their knowledge of how claimant firms operate in this field, can help clients with accuracy and consistency of reserving, achieving their objectives of bringing these types of claims to a conclusion in a much reduced lifecycle.

Our amputation ACE group gives clients access to a forum whereby they can tap into DWF’s extensive resources and experience to understand how best to approach amputation cases. Case handling and tactics deployed by claimant solicitors change over time and being able to spot early challenges and discuss how best to tackle those in such a forum will benefit our clients, reducing costs accordingly.

If you would like more information on our online Ogden calculator or our Ace Groups, please do not hesitate to contact us.

![Case Note: The Star Entertainment Sydney Properties Pty Ltd v Buildcorp Group Pty Ltd [2026] NSWSC 27](-/media/dwf-global-site/images/panel/panel-image-small/insights/0020developmentsexplained320x220smallpanelimage.jpg)